With the pandemic still raging and many industries hanging in the balance, there’s no doubt that times are tough. Your business might be affected and is also experiencing the effects of the crumbling economy. Many consumers realize that paying their bills and dues are more burdensome than before. That’s why if you want to provide your customer with an excellent way to manage cash flow and retain as much of them as you can, we suggest that you get to know more about installment billing.

Whether it’s making payments on your home, car, or business, you can repay loans in biweekly, monthly, bimonthly, or even quarterly payments. In this article, we will discuss everything you need to know about installment billing.

Installment Billing Definition

Installment billing is similar to a payment plan. It lets you split up charges into two or more parts. Your business will have complete control over which charges to the bill in an installment billing model. In addition, you will also have control over the number of separate payments to allow, and when each payment should be due.

Through this payment option, your customers will appreciate the opportunity to pay their bills over time. Although, some may decide to pay the full price all at once. As an incentive, you can offer a discount to a customer who pays in full by the time the first installment is due.

Understanding the Installment Billing Process

Installment billing is all about invoicing customers in segments, instead of having them pay the total amount all at once. The total amount due is then divided equally, by percentage, or according to the configured definition. Each installment invoice includes the following elements:

- The installment number

- The total number of installments

- The installment amount due

- The total invoice amount

You can include other elements like a flat rate or percentage service charge. Taxes are also applied to each installment amount at the time of billing.

To better understand the process of an installment bill, you can create a template for installment bills using a new or existing bill. You control the schedule and when the system will generate installment invoices. The system will then copy all non-amount information such as customer, accounts receivable, distribution of revenue, and discounts, from the template invoice to the installment billing invoice.

When you choose an invoice format, you will have full control of whether or not the system will display a breakdown of the installment billing invoice amounts on the invoice. Online inquiry will also let you inquire about previous and current installment billing invoices. There are three ways to defined the default installment billing plan.

- At the Business Unit

- Bill Type

- Bill Source Level

There are billing software that supports installment billing and will help you schedule and send your invoices whenever they are due for payment. That way, you will get paid right away without any delays. At the same time, your customers will appreciate the efficiency at which you send them your invoice.

Accounting, Taxes & VAT

Every installment billing invoice carries its own information and detail for accounting, deferred revenue, tax records, and discounts/surcharges. The system that you use will copy the default information, except for tax amounts, from the template for installment billing invoices to the individual installment invoices. In terms of accounting, taxes, and VAT, an installment invoice function much like a regular invoice.

Once you generate an installment bill, you also charge VAT (value-added tax) for the amounts due on that invoice at the rate that’s applicable for the tax point and date for the goods or services that are included on the invoice. However, no matter which format you use, the same fundamental rule is always applied: calculate VAT on the amounts that are on the invoice.

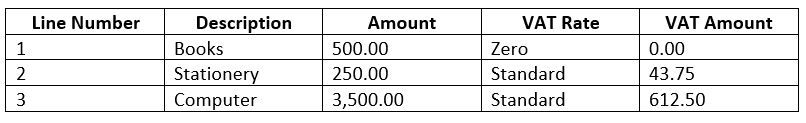

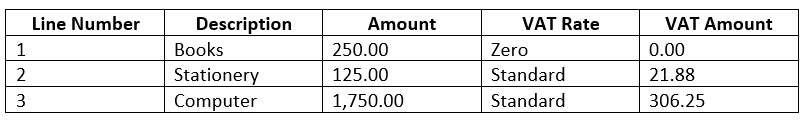

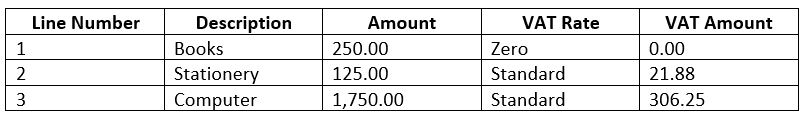

Example of VAT in Installment Billing

According to Oracle, if you issue multiple invoices, one for each installment, the system calculates VAT on the installment total since this is also the invoice amount.

Invoice #1: Due 20 July 2020

- Net Amount = 4,250.00

- VAT Amount = 655.25

- Total Amount = 4,906.25

Invoice #2: Due 20 August 2020

- Net Amount = 2,125.00

- VAT Amount = 328.13

- Total Amount = 2,453.13

Invoice #3: Due 20 August 2020

- Net Amount = 2,125.00

- VAT Amount = 328.13

- Total Amount = 2,453.13

An excellent example of an installment billing plan would be a phone data plan. Once you’ve paid the down payment and submitted the necessary papers, you will be given details on your plan and how you’re going to pay for the total amount. The phone line company will also provide you with all the necessary customer service necessities that you need. From inquiries about device payments to replacing your phone in case of issues, they will offer their services on top of the installment invoices that they send to you monthly.

Pros and Cons of Installment Billing

An installment bill can either be advantageous or disadvantageous to you and your customers. To better understand it’s potential and if it’s a great fit for your business, here are the pros and cons of installment billing for businesses and customers:

The Pros

There are plenty of reason why an installment invoice is the best billing option in today’s economic struggle. We handpicked some of the most significant advantages of this to give you some insight into why it’s an effective billing option.

- Convenience

- One of the many advantages of installment billing is just how convenient they are for both you and your customers. Essentially, your customers can purchase or acquire services from you right now and pay for them later. You can break up the total amount of a large payment into easier-to-pay segments. Payment schedules can also be tailored to suit the salary schedule of your customers. That way, they won’t have any trouble paying all of their payables.

- Easy Application

- Potential customers would also love the easy application process that installment billing offers. In most cases, applying for an installment plan is much easier than applying for an outright loan. The requirements should be easy and simple enough than that of an actual loan. The verification will typically take only one banking day. That means you’re good to go the moment you submit the online application form and other necessary documents.

- Hassle-Free Payment

- With installment billing, your customers won’t have to worry about paying the total installment amount at once. Instead, you will be paying them for separate paying dates until you’ve completed the entire payment. This payment plan provides your customers with a hassle-free avenue. With this option in place, they won’t have to think twice if they’d acquire your services or purchase your products. By giving your customers options, they will more than likely buy more from you once they’ve completed their installment plan.

The Cons

Unfortunately, the sky’s not the limit when it comes to installment billing. Like other billing models, it also has its fair share of downsides that needs to be acknowledged.

- Growing Interest

- Some payment billing plans have interest rates that need to be paid along with the actual payment amount of the installment billing. That means the longer it takes to pay them off, the bigger the interest the consumer is going to pay. As the customer, it may not sound enticing or attractive. Fortunately, you have the option to disregard interest rates and just have your customers pay the total installment amount in segments.

- Depreciation Can Hurt Long Term Installment Payments

- The concept that most consumers do not realize when making an installment payment is depreciation. Take a car, for example. Once you get the vehicle and driver it away from the dealership, it’s already losing value. This means the customer is paying for a depreciating item at full price. The longer the payment timeframe will be, the bigger the possibility that the consumer will be paying more for what he or she bought.

Installment Billing VS Recurring Billing

By now, you may already have an idea about installment billing. Now, how does it differ from recurring billing? This section will tackle both of these billing models to help you distinguish one from the other. At the same time, it will hopefully help you determine which one is the right type of billing strategy for your business.

Installment Billing

To review, installments are also known as ‘payment plans.’ For instance, someone buys a brand new television at the local tech store for $500. He chose to pay as a two-year installment plan. That means that person will pay roughly $20.83 per month for two years to pay up the $500 total amount of the appliance they bought.

Installment payment is more suitable for selling products, with both being viable options for services. Usually, most consumers prefer installment payments when shopping. It promotes a sense of increased purchasing power, all while allowing the consumer to pay for high-value products without severely affecting their current budget.

Recurring Billing

Recurring or ongoing payments are when you pay a set amount to continue using a product or service until payment for a total amount has been fulfilled or if the person chose to cancel or end their subscription. Subscribing to Netflix, for instance, will require your payment information and a monthly bill of your payment plan selected. Recurring billing ensures that you will get your bill per month. At the same time, it also provides different payment options for you to make payments.

A recurring payment is directly related to ongoing services via subscription, plans, or monthly fees. Details such as the payment date, period of service provision, and the cancellation policy are then determined in the service agreement. It is usually required that the service cannot be canceled within a set period. During this time, the customer will be charged via the debit or credit card that they attach to their payment information.

What’s the Difference?

The difference between recurring billing and installment billing is simple. For the former, the card limit isn’t affected. That makes recurring billing the best option for longer payment terms such as quarterly or even annual plans. Gyms, schools, training courses, and SaaS (software as a business) such as streaming services achieve greater results with recurring billing.

On the other hand, installment billing is a better fit for products or services paid in portions. Since these portions are due regularly over a set period, the customer is often charged an interest rate.

Which One Should Your Business Provide?

Before deciding on which payment method to pursue, it’s important to determine your business’s target audience. By doing so, you can pinpoint your customers’ most preferred payment option.

The next thing you’ll need to determine is your business and what it is offering. Again, if you are selling products, then an installment plan is a viable option for you. If you’re subscription services, then recurring billing is a better payment strategy. Make sure you assess your business from top to bottom to determine which billing strategy you should choose.

Wrapping Up

In conclusion, an installment agreement or installment billing is a fantastic way to attract potential and current customers to acquire more of your goods or services. It offers a safe and convenient way for customers to pay for something by dividing the total payment amount into segments. That way, completing a payment won’t be burdensome, especially in the midst of this ongoing global crisis.

At ReliaBills, we go the extra mile when it comes to getting you paid. For more information on how we can help with your installment billing, feel free to check our website or contact us.