For freelancers or small business owners, there’s no shortage of expenses, invoices, payments, and receipts to track. Failing to organize and maintain these important aspects can cost you a hefty sum. But despite all of the things you need to keep track of, do you need to keep track of your billable expense income? If you’re not, then you could be losing money right now without even knowing it.

One of the main reasons why people don’t track their billable expense income is that they don’t know what it even means in the first place. If you have no clue as to what this income is and what it pertains to, you can’t track nor compensate for it.

Keeping track of your billable expense income and adding them to your invoice can be challenging. But no worries – we’re here to lend you a hand.

Table of Contents

ToggleWhat is Billable Expense Income?

There is only a hand few businesses that don’t have any incurring expenses. Most of the time, these expenses are the result of normal business operations. For example, paying your internet provider, buying office supplies, or paying for software licensing. These purchases are commonly called ‘business expenses.’

There are times when a business purchases on behalf of a client. Such purchase is referred to as a billable expense. Therefore, the money that’s paid by a client to cover the expenses incurred on their behalf is called billable expense income.

If it sounds confusing to you, think of it from this angle:

Imagine that you’re a freelance web designer. You have a client that isn’t savvy with the web and has no existing website. For you to progress and move forward with the project, you have three options:

- Purchase for the domain registration out of your pocket and lose the money.

- Guide your client on how to register their domain name and give you access to it.

- Pay for the domain registration fee out of your pocket but inform the client ahead that you expect reimbursement.

As you can see, the idea of billable expense income is pretty common, especially in the freelancing world. Asking your client to order the supplies or services you need can spell doom to the entire project. At the same time, paying for the tools you need out of your own pockets can eat away your earnings. So be sure to get compensated and have them send the reimbursement to your income account.

It’s much easier to make the purchase yourself and just charge your client later.

Adding Billable Expense Income into the Contract Agreement

Before we proceed further, it’s also essential to note that billable expense income isn’t a guarantee unless you put it into writing. That’s why any reimbursement for purchases incurred on your client’s behalf should be included in the contract agreement that’s signed at the start of a project with the client.

The manner of handling billable expenses within a contract will depend on the existing terms of the document itself. If you’re not sure how to address reimbursement and billable expenses in your contract, you can talk to a lawyer to know the bases.

5 Sources of Billable Expense Income That You’re Probably Missing

The examples we mentioned above are just some scenarios featuring billable expenses being put to use. However, you’d be surprised at just how many of these qualifying expenses are often overlooked by most small business owners and freelancers each year. Here are five common sources of billable expense income that you need to know:

Client Communication

Every freelancer has their own craft. For some, it might mean dissecting the code of a new app. For others, it could be mixing music for an upcoming ad video. If someone asks what you do for work, you will probably respond with your craft – whatever it may be.

However, what it will imply that you’re selling yourself short? Believe it or not, there’s a pretty good chance that you are and you’re not even aware of it.

You might be spending most of your days mixing music, or sitting in front of your laptop trying to come up with the best site design. These are all great, but they’re only part of a freelancer’s daily work. If you want to earn money, you need to spend some time communicating with prospects and existing clients.

By charging your clients with a flat rate, your billable hours (which also includes client communication) should be accounted for in your contract.

If you charge per hour, you need to track every minute you spend working on the client’s project. The entire body of work includes sending or responding to emails, talking face-to-face, or going through a conference call.

Failing to track your time properly and efficiently could mean you are giving away hours of your life for free. So, make sure you make the most of your time by charging every second that you spend working on the client’s project.

Planning and Researching

Once in a while, things fall into place naturally, and a client’s project is done smoothly. However, this isn’t always the norm. Instead, accomplishing a successful project takes hours of market research, rough drafts, and revisions once submitted to the client.

If you’re working in the creative field, it can be easy to consider your initial conceptualization as a not actual work. The same goes for performing market research before going through a client’s project. However; if you take all these things away, the final product of your work will fall apart completely.

It’s similar to the time that you spend communicating with the client or the time you spend conducting research and building concepts for your customer. All of these are incredibly crucial and valuable for the entire project. That’s why including these works in your billable hours will ensure that you will get paid for what you deserve.

Fees

The internet has forever transformed the world of freelancing, including how many get paid. But as much as any small business owner or freelancer knows, accepting payment online can also mean paying some pretty hefty processing fees.

By listing these fees as a billable expense, you will be able to save money since you’re essentially passing on the cost of online payment to your clients.

Travel Costs

If you’ve been freelancing for quite some time, you’re probably aware that your clients can come from anywhere in the world. With the presence of the internet, it has become easy to communicate across the globe, regardless of time zones and languages. In some cases, working for a long-distance client requires traveling for on-site work or conference team meetings.

It’s always the responsibility of the employer to cover the costs and reimburse its workers for any business-related travel. If you’re self-employed, you don’t have an employer to cover these costs for you. However, you do have a client.

Whether you’re purchasing plane tickets, booking a hotel room, or the mileage from driving your personal vehicle, make sure all of these billable expenses are taken into account. That way, you can request the customer to reimburse all of the costs that you spent on your work travel.

Materials and Services

Last but not least – and is the most common type of billable expense – are materials and services. However, while these expenses are pretty common, they’re also some of the ones that are easiest to overlook.

The materials you purchase or the services you acquire on behalf of your client will vary greatly depending on your field. Here are some examples of materials and services that you should be listing as billable expenses:

- Advertising costs – e.g., a marketing consultant is purchasing advertising opportunities for a client.

- Creative licensing – e.g., a freelance graphic artist is purchasing the rights to an illustration, font, or photo for a client.

- Supplies – e.g., a small catering company is purchasing specific cutlery for a client’s project.

- Shipping costs – e.g., an artisan is shipping a commission project to a client.

As a rule of thumb, any supply or service that you purchase for a client and have no intention of using for future clients qualifies as a billable expense. So include that into your expense account so that you can add that to your invoice later. In addition, track costs by listing them down or collecting all of the invoices that you get during the entire project.

In the same manner, anything you purchase for a customer that they retain ownership of when the work is complete also qualifies as a billable expense.

What is NOT a Billable Expense?

At this point, you already have a clear idea of what a billable expense is and why you should charge for them. However, keep in mind that not everything you purchase should be passed on to your customer for reimbursement.

Anything that’s considered a necessity for your business is not a billable expense. For instance, the cost of printer ink, or your monthly bill for your internet connection are not considered as a billable expense.

Even if you do purchase a product or service for your client, never count it among your billable expenses if you’re going to use it again for other clients in the future. That’s why it’s essential to think carefully about what you list as billable charges.

Despite that, consider listing and recording each of these expenses. While you can’t ask your clients for reimbursement, you can deduct these purchases from your income tax each year. So always include any billable expenses in your invoice.

Automate Your Billing with ReliaBills Now

Whether you’re shouldering the additional expenses to continue with the project or asking your client to purchase before you can proceed, all of these factors will affect your invoicing. Therefore, you must send quick invoices to your clients to ensure that you get compensation for the expense that you made. That’s why it’s important to improve your invoicing with automation. With recurring billing, you can do just that.

Automating your invoices is pretty important since it ensures that you always get paid for the services you provide, as well as get compensated on time for any expenses you’ve made for your client’s project. In addition, with recurring billing, you can deal with both regular payments and billable expense income all in one system.

ReliaBills is a comprehensive payment processing system that will help you create professional-looking invoices, all while automating your entire billing process. Our motto is “We Do More Than Anyone To Get Your Invoice Paid,” and we stand by that statement with our effective payment processing system.

Why Choose ReliaBills?

Nothing is perfect, but ReliaBills made sure that our subscription invoicing and recurring billing software is close to that mark. We’ve got all the features that you need to automate every aspect of your billing process so that you won’t have to worry about them again. Just set things up, and when you’re ready, we’ll handle the rest.

Automate Your Invoices!

Use ReliaBills to schedule your invoices to be generated automatically and sent whenever you want (weekly, monthly, quarterly, or annually).

Automate Payments!

Save and store customer payment information for auto payments and give your customers the convenience they deserve. You can even process payment automatically even if the invoice amount changes. You can make changes anytime, anywhere.

Invoices Designed for Recurring Billing

Create invoices that are designed specifically for recurring payments! The ReliaBills recurring invoicing software displays current amount due and late payment due invoices, as well as open balances. In addition, each of the invoices you create will be formatted automatically to both electronic so you can automate it right away.

Recover Failed Payments Like a Boss!

Payments tend to fail at any given moment. Fortunately, ReliaBills will do retries on failed payments and notify you and your customers about it. In addition, our system will even guide your customers towards resolving the issue by updating their payment or card information.

Secure Customer Portal

ReliaBills provides a customizable portal that lets you view invoice and payment history, manage customer payment information, and generate statements. Your customers can also enter and save their payment information so they won’t have to enter these details manually whenever they pay you.

Comprehensive Reporting

With our comprehensive reporting tools, you will always know which of your customers owe you money. At the same time, you will also know what invoices are sent and when and which of your customers have already made payment.

How to Create a New Invoice Using ReliaBills

Creating an invoice using ReliaBills involves the following steps:

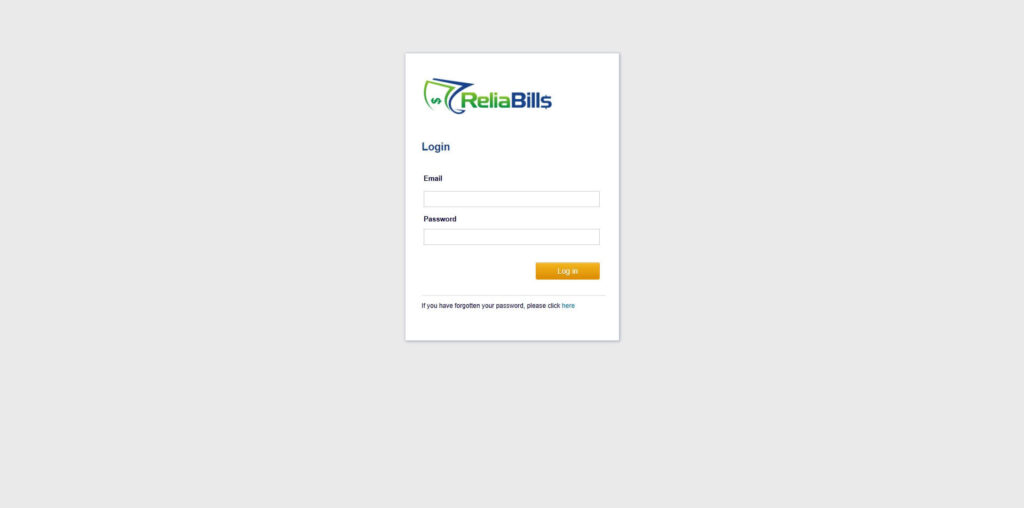

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

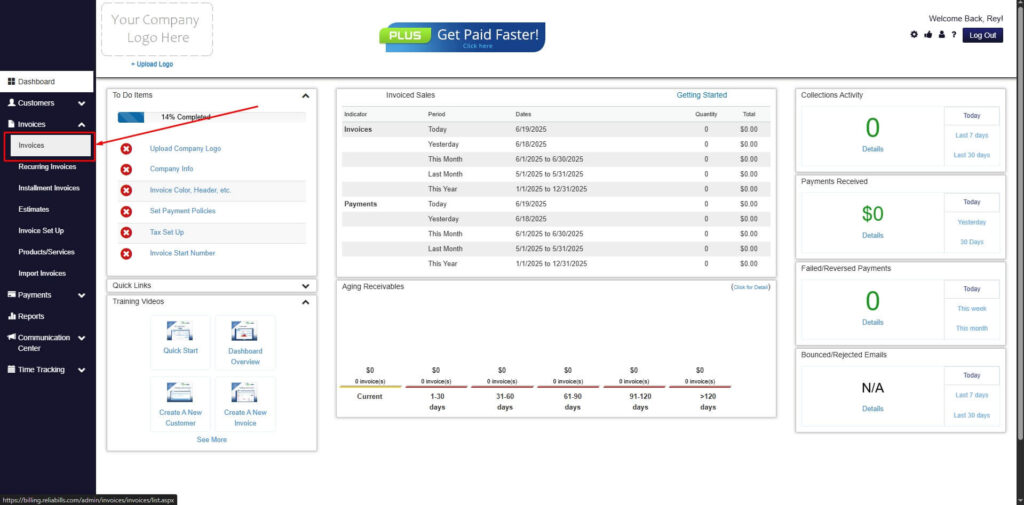

Step 2: Click on Invoices

- Navigate to the Invoices Dropdown and click on Invoices.

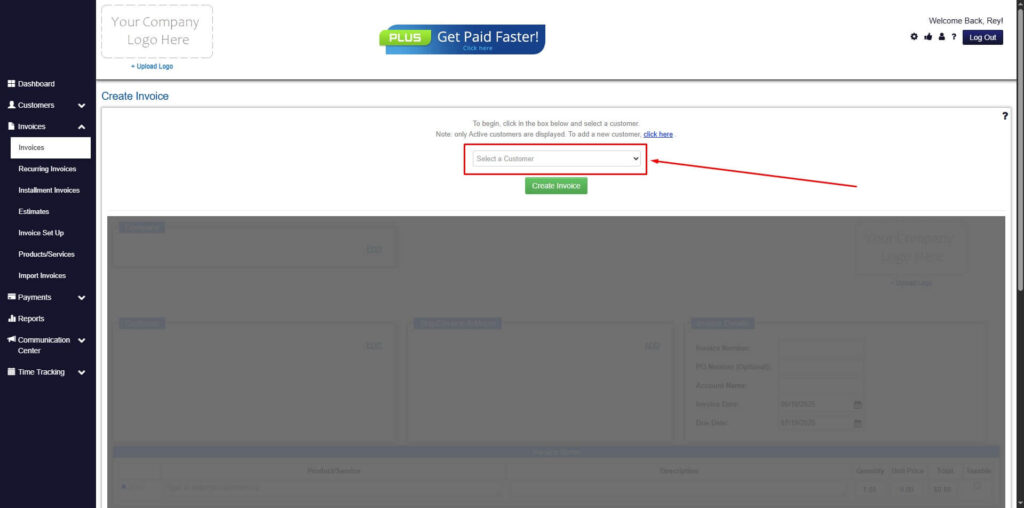

Step 3: Click ‘Create New Invoice’

- Click ‘Create New Invoice’ to proceed.

Step 4: Go to the ‘Customers Tab’

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 5: Create Customer

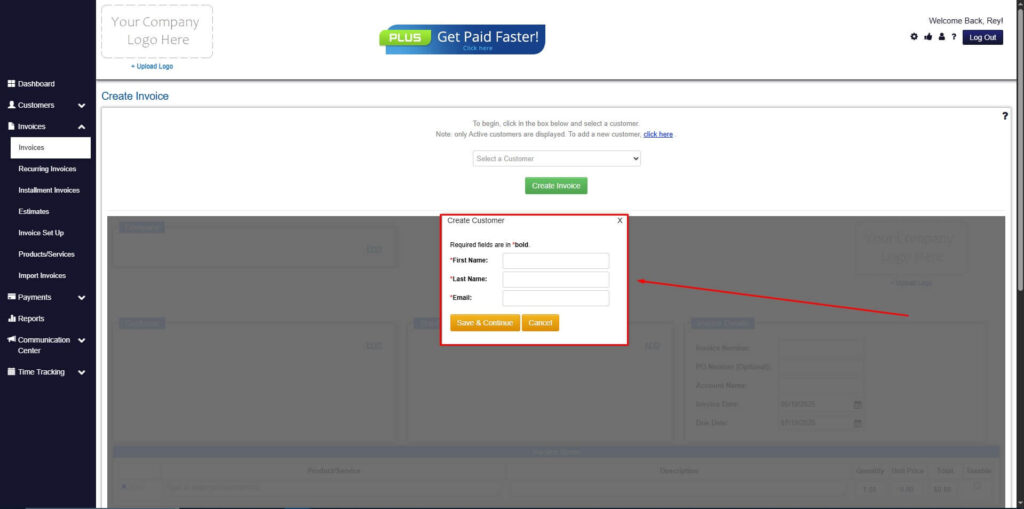

- If you haven’t created any customers yet, click the ‘Click here’ to create a new customer.

- Provide the First Name, Last Name, and Email to proceed.

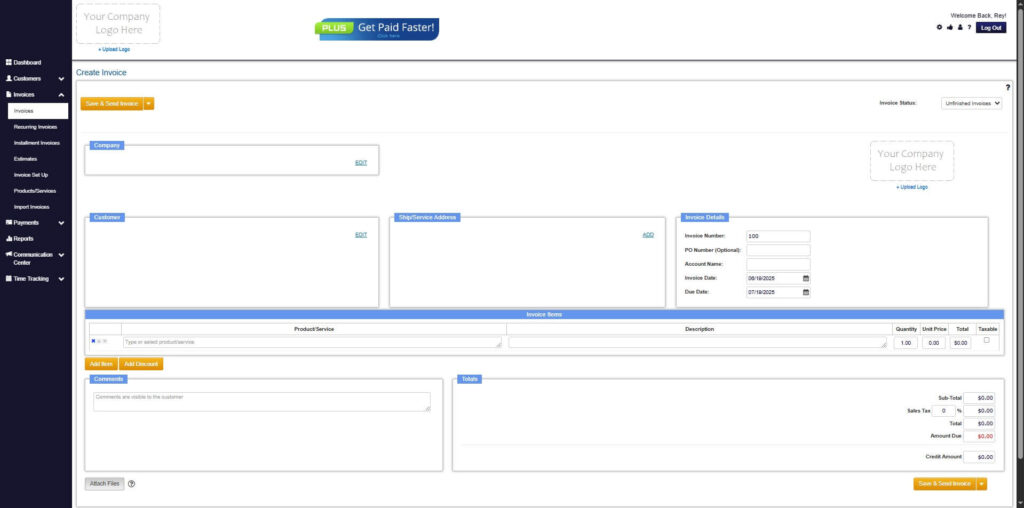

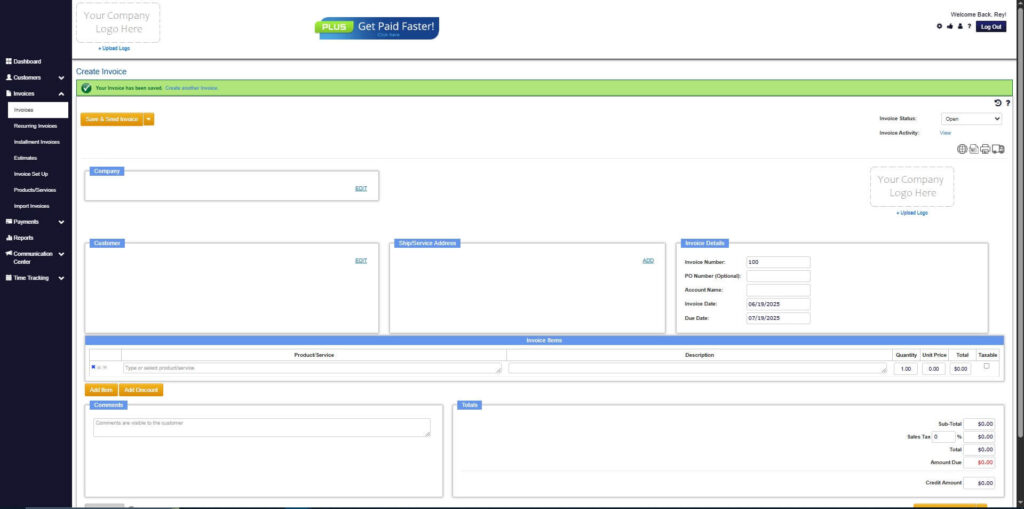

Step 6: Fill in the Create Invoice Form

- Fill in all the necessary fields.

Step 7: Save Invoice

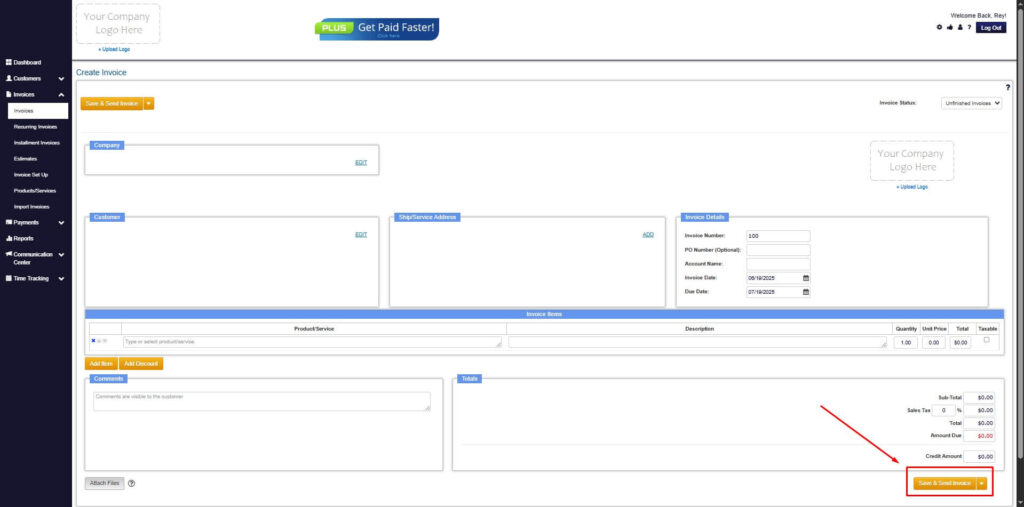

- After filling out the form, click “Save & Send Invoice” to continue.

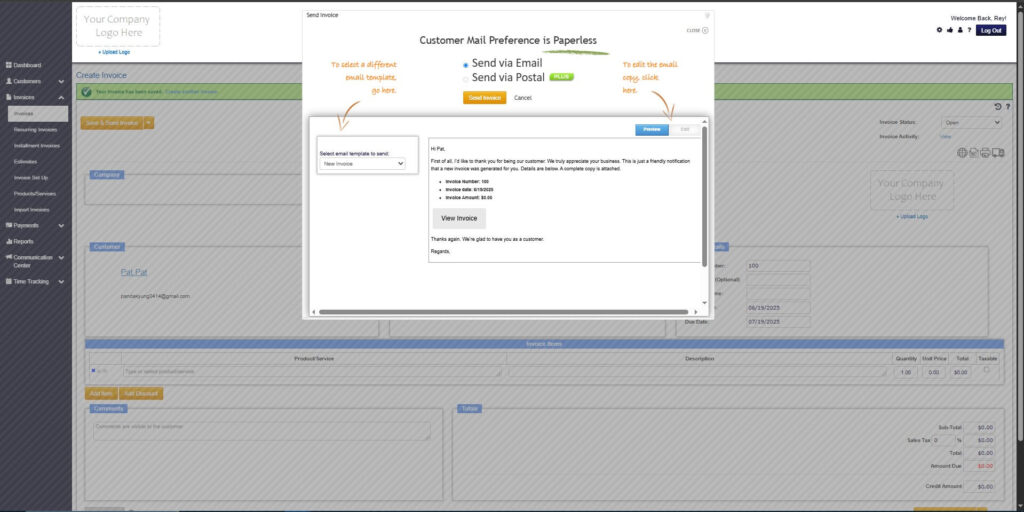

Step 8: Invoice Created

- Your Invoice has been created.

Wrapping Up

So, as you can see, a billable expense income is a necessity if you’re a small business owner or freelancer. If you value your time and your expertise, never overlook these expenses and think that they’re minor things. When they add up, they will cost you a hefty sum. So always track billable expenses and include them in your client’s invoice.

For more information about how to track billable expenses and adding them to your invoice, send us a message on our email address at sales@reliabills.com.