As a business owner, you might feel like you hear these terms all the time. Or maybe you’ve heard the terms but weren’t really sure how or if they applied to your business. There’s a good chance they do! In our current digital age, small businesses can be competitive in many ways that were previously unavailable to them. That includes subscription billing software, which allows businesses to implement effective recurring billing systems that save time and resources, while also improving delivery and responsiveness.

So, what exactly is the difference between those billing terms? And more importantly, which form of billing should your business be utilizing?

In this guide, we’ll cover the ins and outs of subscription billing. We’ll take a look at how the billing process works, as well as how the payment process works. Then, we’ll cover the different forms of subscription billing and when they apply. And finally, we’ll help you understand what to look for when choosing a subscription billing software and which available software choice is the best.

Table of Contents

ToggleWhat Is Subscription Billing?

For starters, when we talk about these terms: subscription billing, recurring billing, and installment billing, it is helpful to know that they all fall under the umbrella of a subscription.

The subscription business model is one in which customers agree to pay for a service over a specified period of time. Most subscriptions tend to have two defining parts: its service and its billing.

- Subscription Service – The subscription service defines what product or service the customer is to receive.

- Subscription Billing – The subscription billing defines the cost of the product or service to the customer.

For example, let’s use the well-known subscription model of Netflix.

- Subscription Service: Full access to the Netflix streaming content.

- Subscription Billing: A monthly charge of $12.99.

Understanding the Billing Process of Subscriptions

To better understand subscriptions, we need to get a sense of how the billing process works. Nearly every subscription you come across will have a start date, a payment frequency, an amount, and a duration.

Let’s break down each of those parts:

- Start Date: Date when the first billing occurs.

- Payment Frequency: How often a payment is expected.

- Amount: The dollar amount of each payment.

- Duration: Length of the subscription period.

Billing can be a simple and straightforward process where you have the same amount due at a regular and defined frequency. Garbage removal services are a great example of this. Or, you can have billing where the amount changes but the frequency does not. An example of this would be your utility bills, where the amount differs each month based on your usage.

Because billing can differ in its implementation, contracts play an important role in clearly defining the details of the service and the corresponding payment.

Businesses are constantly adapting their products and services in an effort to appeal to more customers. One common effort is to define a service or the content of a product into tiers, such as Gold, Silver, and Bronze. The tiers may offer varying levels of quality, access, perks, and more to correspond with the tier’s given price. Customers may also elect to move between tiers, which is often referred to as upgrading or downgrading.

In an effort to gain new subscribers, savvy subscription marketers utilize free trials or introductory offers. These offers are essentially short-term subscriptions for reduced rates or $0-rates that are then followed by a longer-term subscription for a greater, pre-defined amount.

Understanding the Payment Process of Subscriptions

In order to get the whole picture of how subscriptions work, we also need to take a look at the payment process.

That traditional practice of sending your client a paper invoice and waiting to receive their payment is no longer common practice in our modern subscription environment. It simply takes too long to actually get paid. In most cases, the next billing cycle will have already concluded before you even receive payment for the previous cycle. Not to mention the level of effort and cost involved in generating and sending out paper invoices, as well as the cost to receive and record the paper checks.

Your business doesn’t need a system that creates more problems it needs one that offers recurring billing solutions. That is why the use of email as an invoicing tool has become invaluable to subscription billing. Its low cost and immediate delivery makes it the ideal delivery mechanism.

There are a few downsides, of course, as you can’t control how or when the email is received. For example, an email might accidentally get blocked by spam filters or go overlooked in a crowded inbox. But it remains a far superior choice when compared to the older methods.

Advances in e-commerce and banking have also been extremely valuable, such as the ability to pay a subscription online or set up automatic payments. These advancements have eliminated mailing delays and other late payment issues.

What Is Recurring Billing and How Does It Work?

Simply put, recurring billing is a form of subscription billing. To be more precise, it is the most common and straightforward form of subscription billing.

A recurring billing system establishes a defined schedule or frequency of payments, usually monthly or annually, and might involve sending an electronic invoice. These payments may be for the same amount every period (known as fixed billing) or the amount may differ based on the customer’s usage (known as variable billing).

Additionally, the recurring billing is typically for a pre-defined service or level of service and does not involve trial periods or upgrades. And perhaps the most important aspect of recurring billing is that it involves the automated billing of a securely stored payment method, such as a credit card or bank account.

Common examples of recurring billing with a fixed price: Website hosting services, childcare, home security systems, and content streaming services.

A common example of recurring billing with a variable price: Utility services.

What Is Installment Billing and How Does It Work?

Just as with recurring billing, installment billing is another form of subscription billing. It is typically used in financial transactions where a lump sum is due.

The installment billing system divides the amount due to a pre-defined number of payments, allowing the customer to pay in portions (i.e. installments). Because these payments are made in installments over a period of time, the customer is typically charged a finance fee.

Payments may be calculated to include the finance fee, which is typically based on the principle amount, the frequency of payments, and the length of time over which the payments are to be made.

Common example of installment billing: Loans.

Is a Membership Considered a Subscription?

This is an interesting question to consider: Should memberships be viewed as a form of subscription billing?

From a financial aspect, we can say: Absolutely, yes.

The same rules, practices, and policies that we discussed above for subscriptions are used for billing membership fees and dues. In many ways, it comes down to how a business or organization wishes to view the relationship with their customers.

For example, when you pay your electric bill each month, you likely don’t consider yourself a member of the electric company. However, in some cases, co-op utility companies do consider their customers to be members. Either way, membership or not, both utility companies use the same subscription billing practices.

We’re delving into the semantics a bit here, but the takeaway is that while the term membership is generally used to imply a notion of belonging, the actual billing practice is just like that of a subscription.

How Do I Choose the Best Subscription Software?

Now that we’ve covered the different types of billing, you should begin considering the specific needs of your business and which category of billing you fall into.

As you evaluate the different choices for subscription billing software, identify what your most common sequences and billing frequencies would be. Does the software accomplish these? Your business will need these capabilities to thrive.

Just as important is to identify your exceptions. Think about which scenarios occur from time to time that requires your intervention. Does the software allow you to accommodate these exceptions? Going without will mean investing more time and resources into troubleshooting.

Remember! As you weigh the choices, there are 3 goals that you absolutely want to accomplish with your subscription billing software:

- Automation: This needs to be a key facet of your subscription billing software. As your business grows, you can’t spend precious time on billing and invoicing. So, take the hassle out of billing with automation and focus on the bigger things.

- Flexibility: You need a system that is simple and offers flexibility (not complexity). If you’re spending a ton of time on a small percentage of customer billing issues, then you definitely have the wrong system.

- Customer Satisfaction: If you’re not completely satisfied with your subscription billing software, if it’s not saving you time and resources, if it’s weighing you down rather than helping your business grow, then you don’t have the right subscription billing system in place.

We’ve often found that providing our customers with a recurring billing system that achieves both (1) automation and (2) flexibility the result is (3) customer satisfaction. This is our top priority and should always be what you expect and receive from your recurring billing software.

What Makes ReliaBills the Best Recurring Billing Software

You want the best recurring billing software for your business but still might be uncertain which software option to choose. If you take a look at the features of our ReliaBills recurring billing software below, you can clearly see why we’re a step above the rest.

Automatic Invoice Generation

This is a crucial element for businesses that want an effective recurring billing system. With ReliaBills you have the ability to automatically generate invoices. And send them to your customers at the frequency of your choosing.

Specialty Invoice Formats

ReliaBills invoice formats are specifically designed for recurring billing. They always display the current invoice balance along with any other open account balances. So, even if the amount billed is the same every month, the customer can always tell if they have past due invoices.

Invoice Date Tags

If a customer falls behind on payments, it can often times get confusing as to what has been paid and what balance remains. This is especially true with fixed recurring billing amounts that appear the same each month. ReliaBills displays date tags on invoices that are auto-generated so that the customer can always reference the month of service.

Fully Functioning Merchant Account

When it comes to billing, an unfortunate reality is that occasionally credit cards will fail. Insufficient funds will cause declines. That’s why ReliaBills includes a fully functioning merchant account because embedded payment processing is crucial.

When a payment fails, ReliaBills identifies the exact reason for failure, whether insufficient funds, expired card, or another, and instantly notifies the customer. Thanks to the direct integration with our payment processor, ReliaBills is able to then launch an automated process of scheduled notifications and payment retries based on the customer’s specific reason for the decline.

Automatic Payments

Allow your customers to set up automatic payments for both fixed and variable recurring billing with the certainty that their credit card and bank information is secure. With ReliaBills, you also get a brandable customer portal that allows customers to self-manage their payment information.

Automated Engagement

ReliaBills does not persistently demand, badger, or intimidate your customers. We help you thrive by engaging your customers. Utilize our Engagement Manager to define the content and timing of messages, as well as their method of communication, whether it is email, text, or snail mail. Then, simply set it and forget it. It’s all taken care of for you from there.

Choose the best recurring billing software for your business. ReliaBills helps you save time, simplify your process, cut down on late payments, and nurture strong customer relationships. Avoid payment problems altogether with our recurring software. If you are interested in learning more about how our software can improve the billing process for your business, contact ReliaBills at 1.877.93BILLS (877.932.4557) or sales@reliabills.com.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

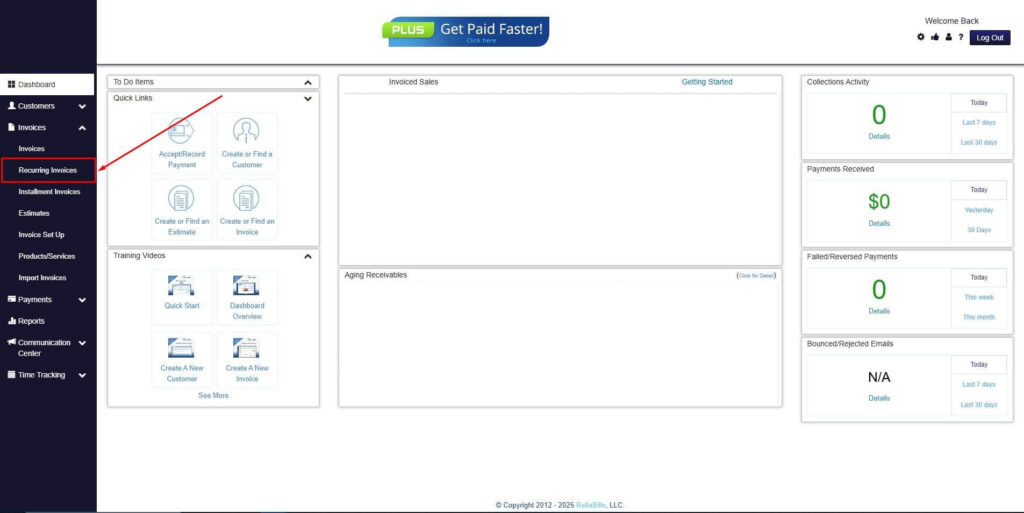

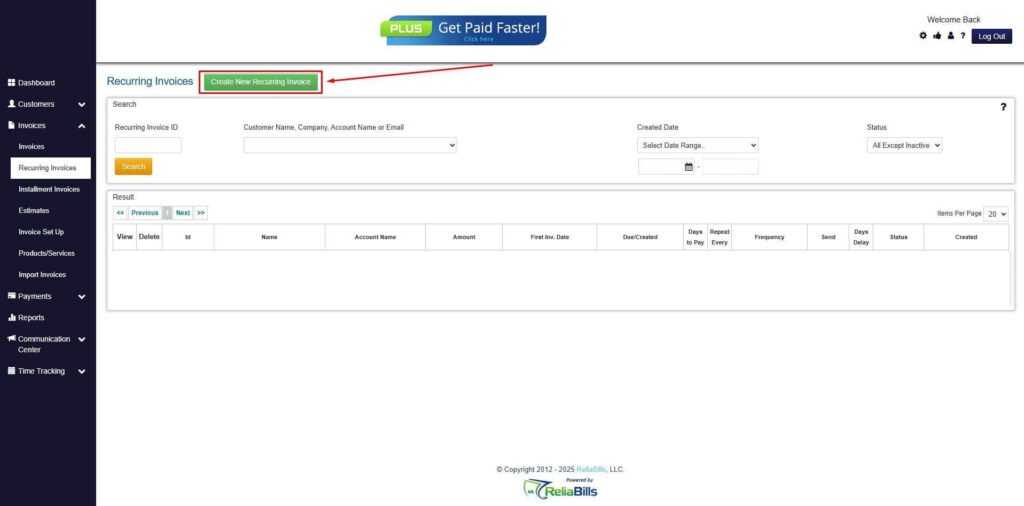

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

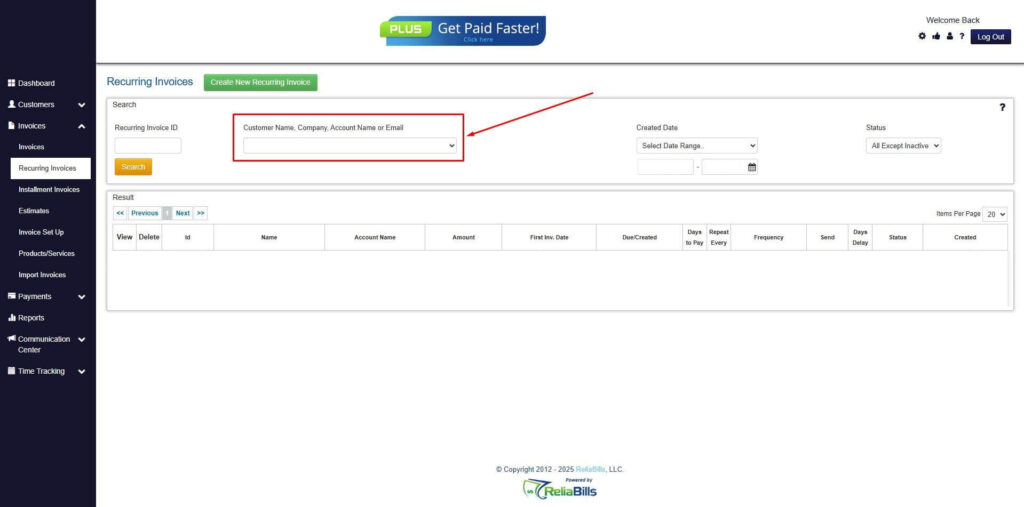

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

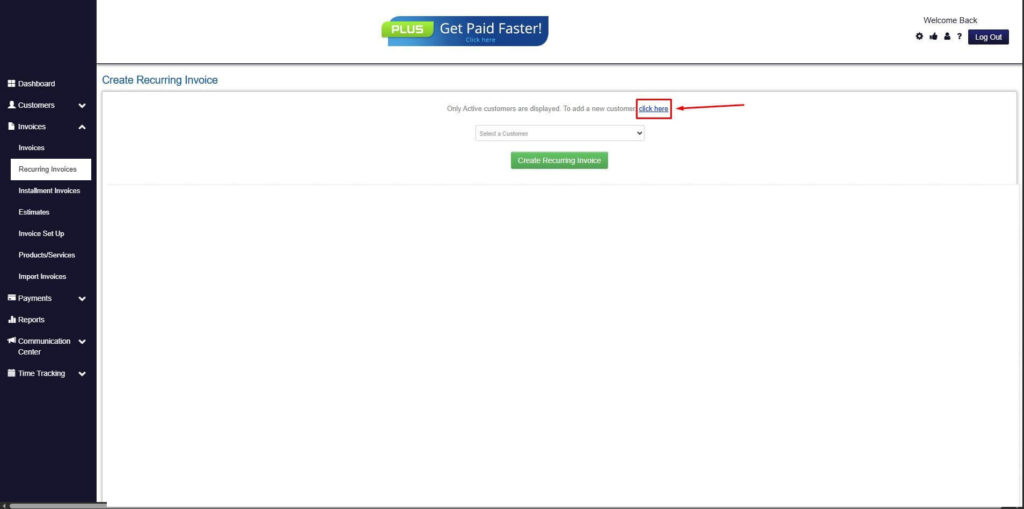

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

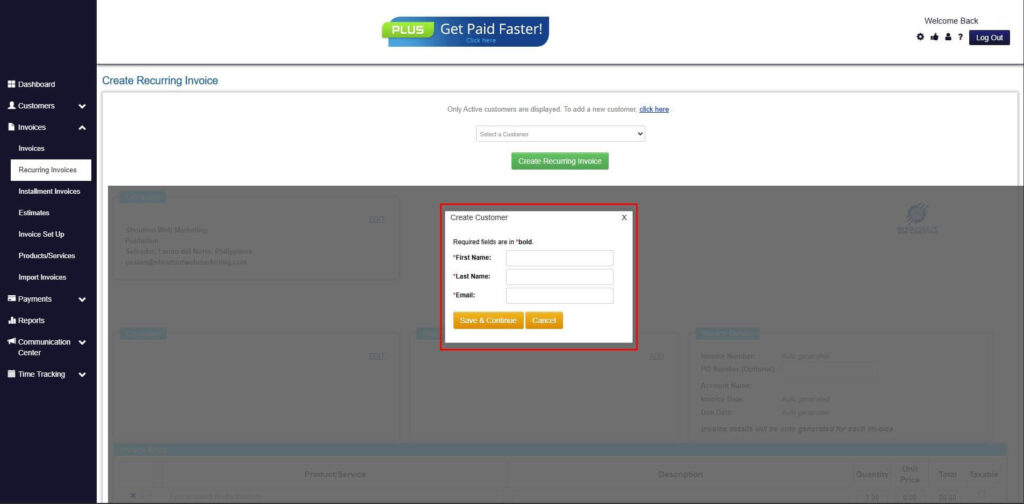

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

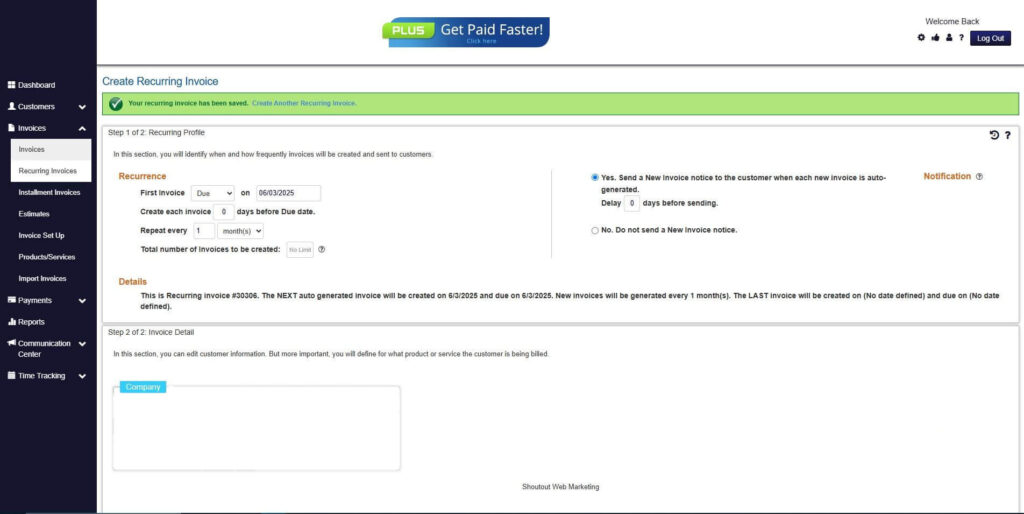

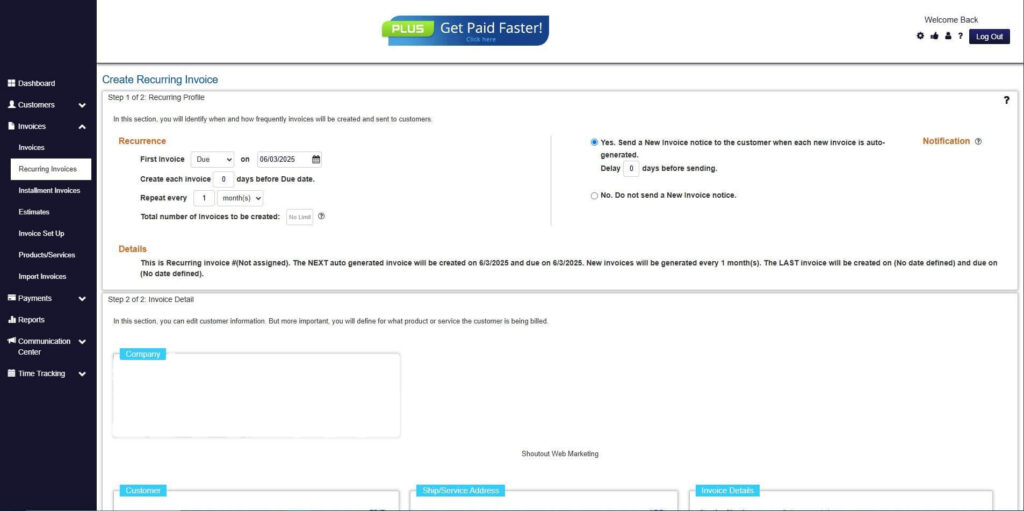

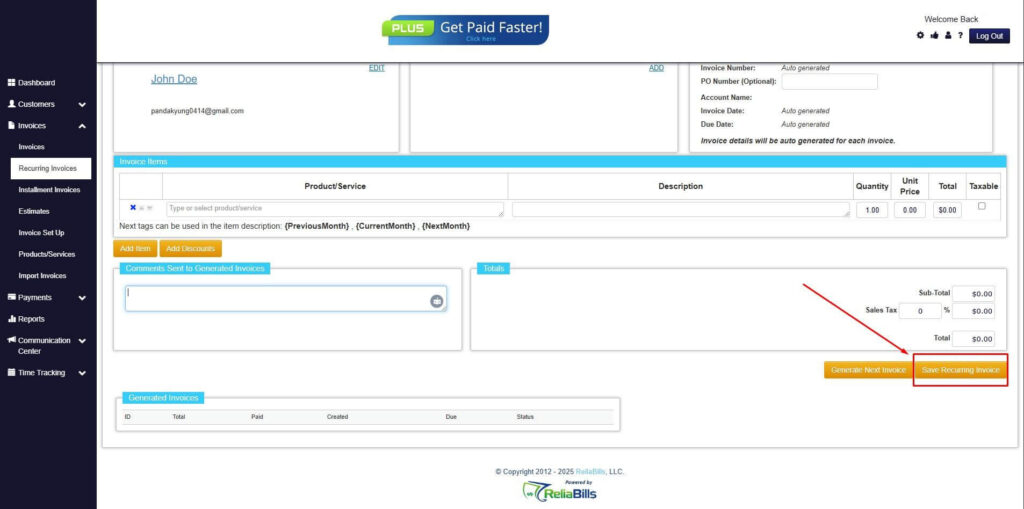

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.