For merchants looking to grow their client base, build customer loyalty, and increase cash flow; subscription billing can be an effective and profitable payment tool. It has a lot of potential and upside that you would want to take full advantage of. One of the only challenges in choosing this billing tool is deciding which path is best for your customers: monthly or annual billing?

Table of Contents

ToggleMonthly vs. Annual Subscription Billing

Similar to many situations in customer payment models, there are pros and cons to each of these methods. The most significant pro is that whatever option you choose, there are unique advantages that can help build your customer base and increase revenue. The subscription industry is only continuing to grow, which has made recurring billing the absolute norm for many businesses. Many business owners have realized the value of turning one-time customers into repeat buyers by locking them into becoming regular customers.

The perks of subscription billing can be apparent for most businesses. First, subscription billing ensures that funds are flowing regularly into your business accounts. Once a customer is attracted to your product or service, they will more than likely stay loyal to your business since they don’t have to remember to continually purchase from your company. However; before you can achieve that level of success, you need to decide which type of subscription billing you should choose. That’s why in this article, we will break down all the factors that you’ll need to consider before you select the right choice between annual vs monthly billing.

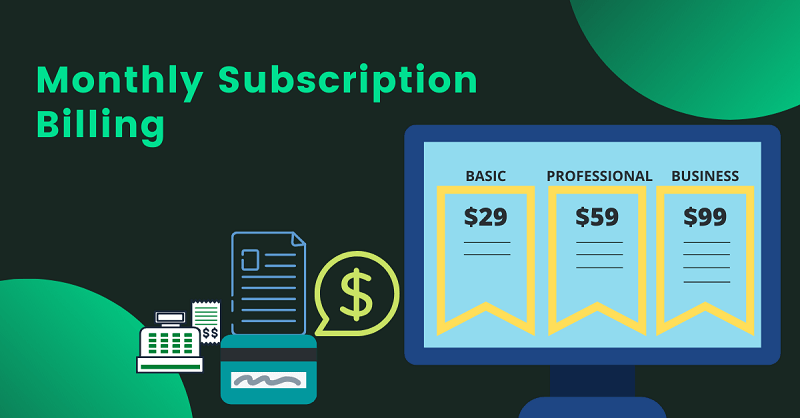

The Pros of Monthly Subscription Billing

The most significant advantage of implementing a monthly subscription billing model is that there are lower upfront costs for your customers. Since some customers are cautious of signing up for long-term commitments, having the ability to pay monthly billing offers less risk to those customers who aren’t ready to fully commit yet.

Since your customers will be paying monthly, this method will cast a broader customer net over the number of shippers who are willing to engage with your product or service. This option can also help increase the number of customer acquisitions and improve the chances that you will keep them coming back every month. If your company is looking to launch a new product or service, a monthly billing option will allow customers to have proof of concept before they decide to buy into the larger business model.

From a business standpoint, monthly subscription billing also guarantees that funds are always flowing into your accounts on a regularity. Monthly subscriptions can help your relationships across the payments ecosystems, as well as help your business calculate what your revenues will be per month. When you look at it from a budgeting and accounting standpoint, monthly billing is easier to manage.

The Cons of Monthly Subscription Billing

A distinct drawback of monthly subscription billing that shouldn’t be overlooked is having a lower barrier to entry which makes bailing easier. If your company is trying to market a new product or service, allowing customers to choose if they want to keep the option on a monthly basis, will make it easier for them to cancel their subscription.

Since building customer loyalty is a prime benefit of monthly subscription billing, you should consider if offering a monthly option makes it too easy for your customers to try the product or service once and cancel the account after a short trial period. Monthly billing also makes customer acquisition costlier than customer retention. This drawback is something that you must weigh before deciding on which billing model to choose.

The Pros of Annual Subscription Billing

The most significant benefit of choosing an annual subscription billing is the assurance that you’ve secured that customer for a more extended period. This billing option helps ease cash flow concerns and makes sure that revenue is set for that specific customer for a defined period. From an accounting standpoint, annual billing also helps reduce internal costs and is associated with monthly invoicing or payment collection.

An annual billing option also helps establish a defined customer loyalty strategy. Offering an annual option shows your customers that you have a prove-tested model to last in the market, which can help assure them that your company is solid, reliable, and well-received by other customers. To put it simply, annual billing is easier to manage.

Annual subscription billing is also a way to market a lower price point to your customers. As a way to entice customers to engage at a much lower fee, SaaS companies typically offer annual plans at a lower rate than the monthly option. In most cases, businesses provide both an annual and monthly subscription. That way, their customers are more empowered to choose the model that works best for them.

The Cons of Annual Subscription Billing

The biggest flaw of annual subscription billing is the upfront costs to the customer. Since an annual commitment requires more money at once, the large expenses might turn some customers away. For customers who are wanting to test a product or service before they entirely buy into the model, annual plans might be too much of a commitment for them.

In addition, annual subscription billing might cause some logistical errors on the dispute side. Since a customer may forget that they made an annual billing commitment to a specific service, when that bill shows up the second time, they might have already forgotten what it is for and dispute the charge. This issue can lead to friction in your payment processes, and increase the chance for chargebacks. This issue makes an annual contract a risky option.

Which Subscription Model Should You Choose?

Regardless of which model is ideal for your business and your customers, you can rest assured that the benefits of whatever subscription billing you choose will outweigh the drawbacks. Customer acquisition and retention are the goals of every business, and a subscription billing model can help boost both ends.

Subscription billing can also help diversify the payment types of your business since the payment processing partners that offer the best recurring business models also have flexible payment method integration. They also allow your customers to provide flexibility in when and how they want to pay for the particular type of subscription that they acquire. Regardless of which route you choose, it’s essential to focus on delivering transparent practices, so that your customers know when, how, and why they are being billed for your product or service.

Keeping easy and simple sign-ups and terms will help increase customer loyalty and decrease the chances that they’ll dispute any recurring billing charge. It will also give your businesses better peace of mind that revenue will be flowing into your accounts regularly.

So the bottom line is that you can choose one among monthly and annual billing and still reap all of its benefits. You can even offer both to give optimum diversity and options to your clients. That way, they will be making the decision of which is more convenient for them, instead of you making assumptions.

How ReliaBills Can Help

ReliaBills is an excellent complement to whatever subscription billing model you choose. Whether you go for the more commonly occurring monthly, or the long-term annual billing, you will conveniently reap all of their benefits with the help of ReliaBills. While a billing model is essential, it isn’t as effective without an invoicing system.

With our software, you can send invoices to all of your customers who subscribed to your services. You can customize your invoices to make them look more professional. At the same time, you can schedule when to send them and to whom at any given time. That way, you will always get paid on time without any delays.

With ReliaBills, you can have options that can benefit you and your company. Most of all, ReliaBills is completely FREE. That’s right! You can start taking advantage of all its features right away without the worry of paying anything. If you want to access more options, you can upgrade to ReliaBills Plus at just a minimum fee of $24.95.

Recurring Billing with ReliaBills

As mentioned before, the subscription industry is only growing, which has made recurring billing the absolute norm for many businesses. That means having recurring billing software as a subscription-based business is crucial. So if you don’t have a recurring billing strategy in place, you will struggle to run your businesses smoothly. Fortunately, ReliaBills can help.

ReliaBills is more than an invoicing system. It also offers other relevant features that aim to get you paid on time – including recurring billing. When you create your invoice via ReliaBills, you also have the option to schedule your invoice and even set it to recurring. That way, you won’t have to make a different invoice per month. All you need is to make the necessary edits like the dates and the price, and you’re all set.

ReliaBills will also help you onboard your customers, create the ideal pricing plans, and bill your customers on time. All of these features will help you save time and money in the long run since you won’t be spending much of them on your invoicing duties. You can then allocate these resources to other relevant ventures to help grow your business.

With recurring billing, you won’t have to think about invoicing ever again. Everything is done automatically, which means no more tiring manual work. The only tricky part you will ever do is setting things up. Once everything is in place, all you need to do is sit back, relax, and watch the magic of recurring billing happen.

Our recurring billing software offers invoice creation of any kind. That means you can create invoices designed specifically for recurring payments. As a subscription-based business, sending regular invoices isn’t suitable for you. Instead, you need to create invoices that are explicitly made for invoicing.

How Does Recurring Billing Benefit Your Business?

Any subscription-based business can get tons of advantages from sending recurring invoices from an invoicing solution like ReliaBIlls. Here are five compelling benefits that you should know:

Improvement in Cash Flow

Having a recurring billing strategy means you will have a steadier stream of income. It improves business cash flow every month, which means you’ll have enough money to cover all of your business-related costs and expenses. Apart from that, recurring billing also boosts your cash flow projections. For example, when your customers pay their monthly fee, you will know that you can secure a certain amount of income coming from them.

Quicker and More Efficient Payment

People are used to paying bills regularly. People are accustomed to habitually paying their bills from phone, internet, cable, or rent whenever it comes. When you send your invoices at recurring intervals, you will encourage your customers to lock into the same payment routine, which means the speed at which you will get paid will increase drastically.

On top of that, any invoicing systems like ReliaBills will let you link to a client’s credit card. Not only does that encourage prompt payments, but it will also make it convenient for your clients to pay you. Remember, the more convenience you give your customers, the more likely they will acquire your services again.

Reduce the Time It Will Take to Chase Payments

Since recurring billing speeds up the payment through convenience and effectively cultivating good habits, you will spend less time chasing delayed payments. That means you won’t have to worry about the awkwardness of asking your clients for payment.

Automate EVERYTHING

The main takeaway of recurring billing is that it puts everything in cruise control. By using software like ReliaBills, you can create invoices, set schedules, link your client’s cards and make the relevant changes all at once. This level of convenience will give you the peace of mind you deserve since all of your invoices will be sent on a regular schedule for quicker payment. Duplicating work will no longer be necessary since everything is done automatically.

In addition to that, ReliaBills will also let you review recurring invoices before you send them. This practice is ideal for clients that have fluctuating monthly values. For instance, let’s say your client has a recurring invoice worth $300. But in one particular month, your customer either acquires more of your product or service and increases their bill to $350. With recurring billing, you can instantly make that change in that particular month without having to edit your entire billing strategy.

Improve Customer Relationship

Recurring billing aims to automate your billing process and make life easier for you. But apart from that, it also helps improve your relationship with your customers. Again, convenience is the key to your customer’s heart, and recurring billing is meant for that type of benefit. As a result, the recurring relationships between you and your customers will be the basis of forming a longer-lasting business connection that will benefit both parties.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

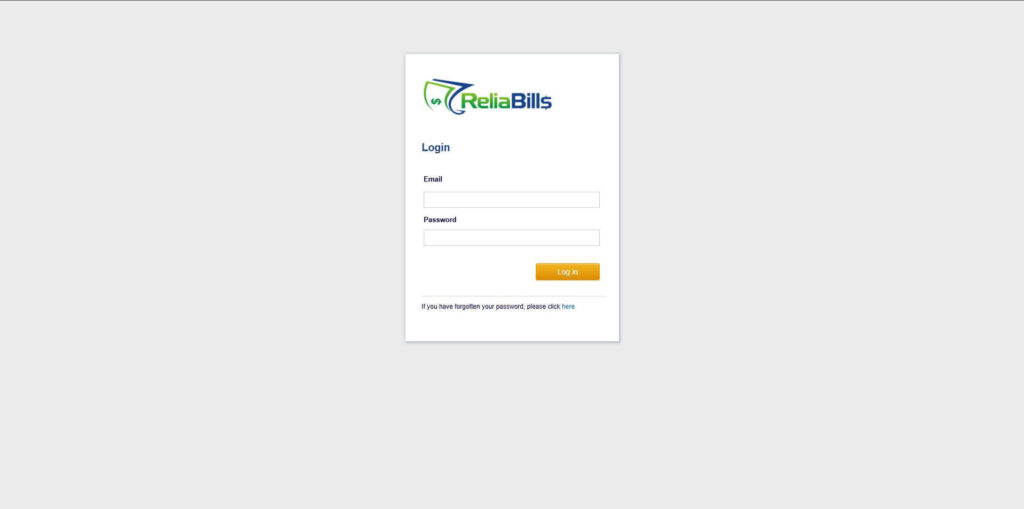

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

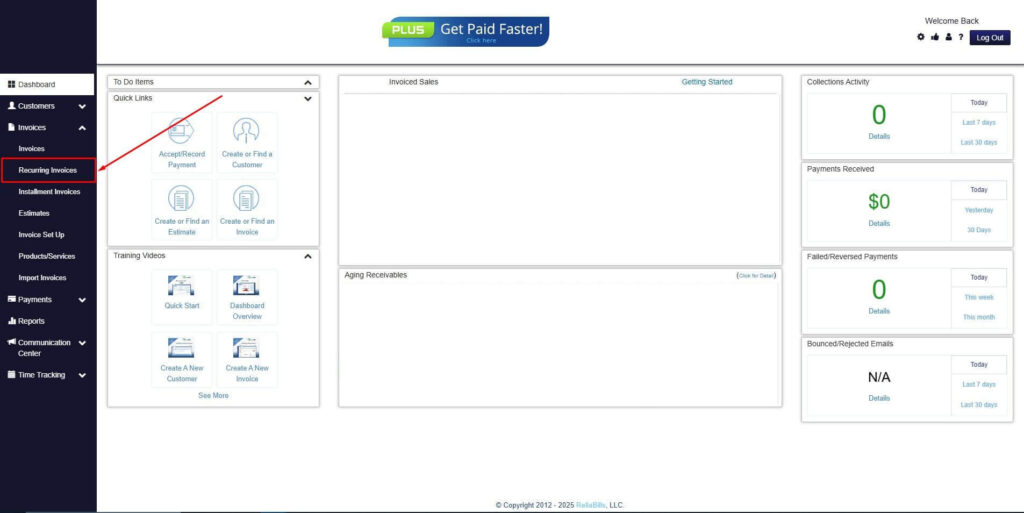

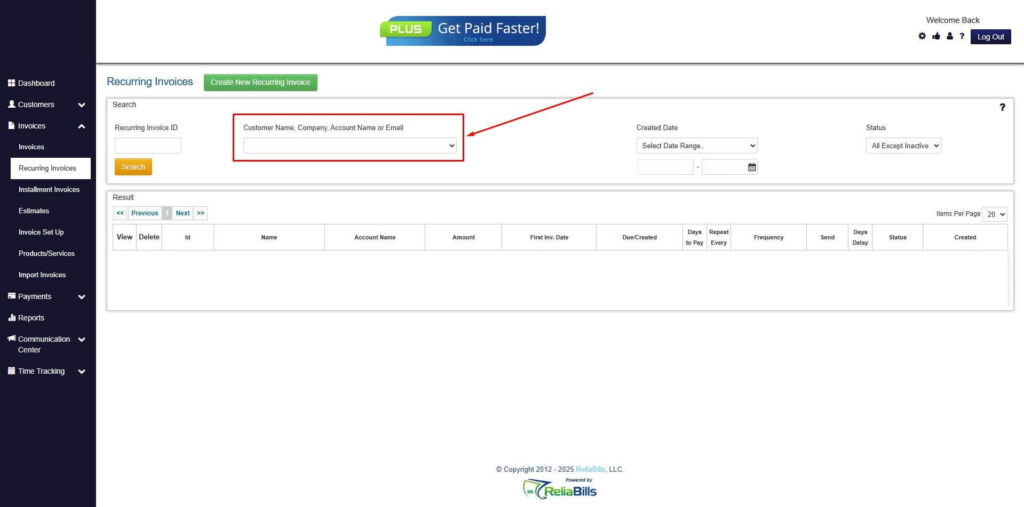

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

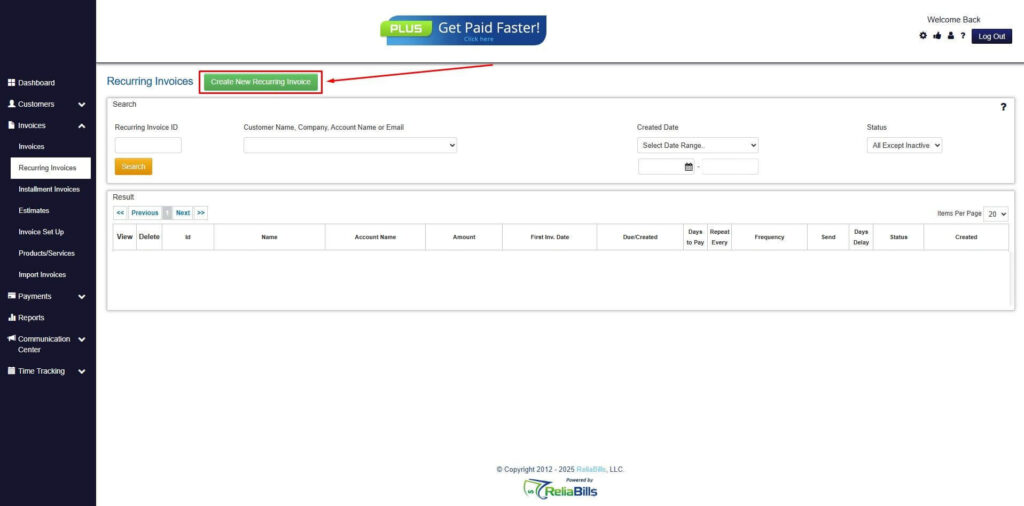

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

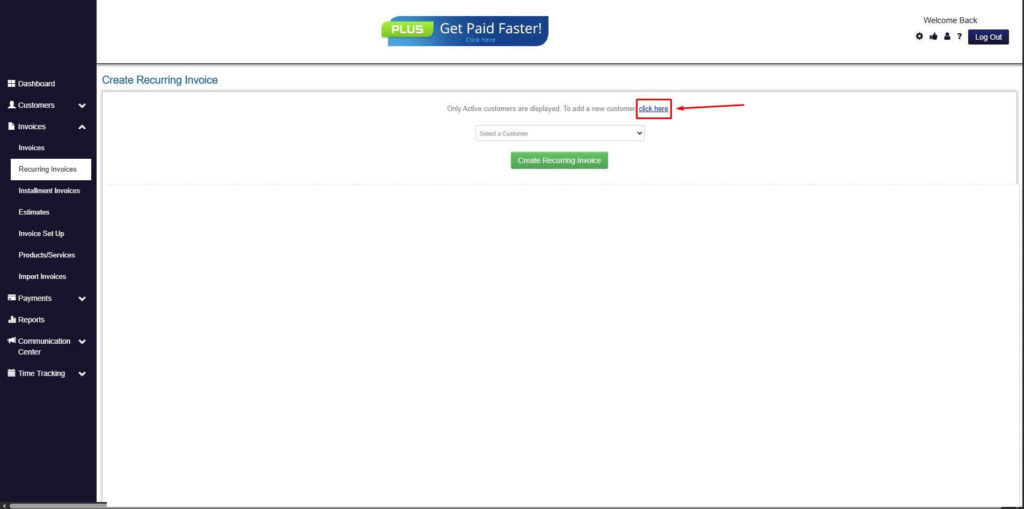

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

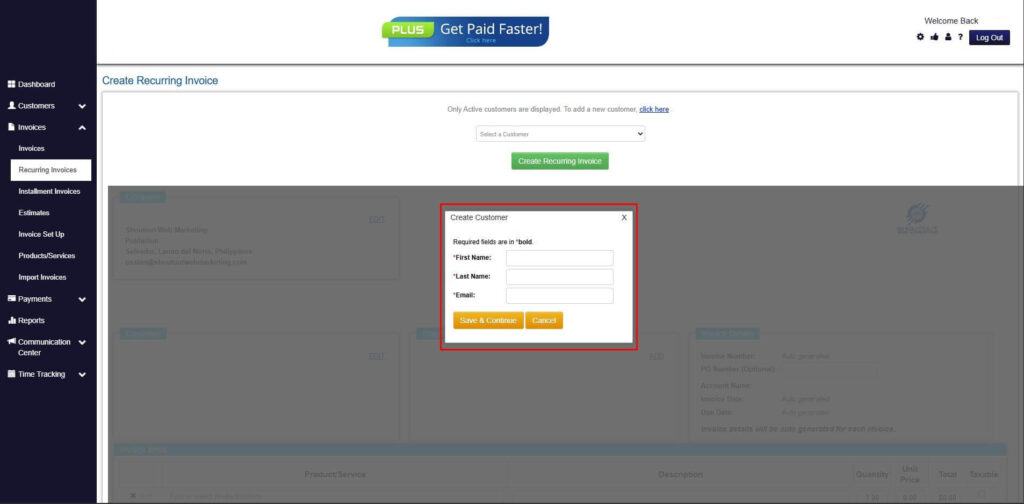

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

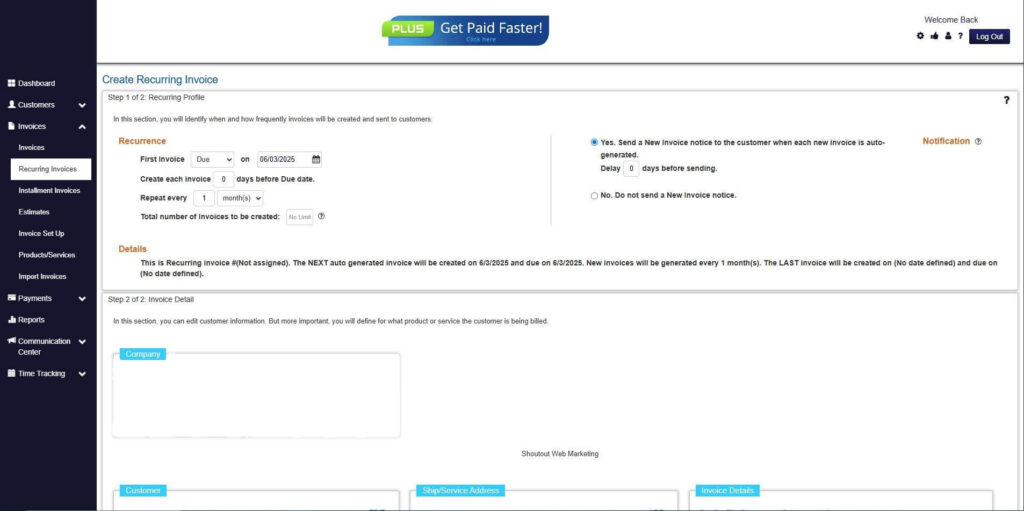

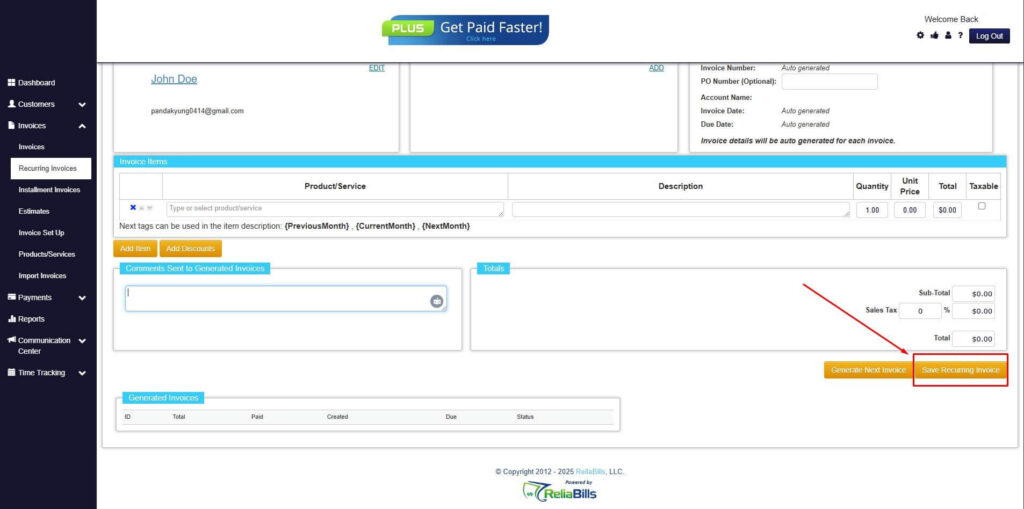

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

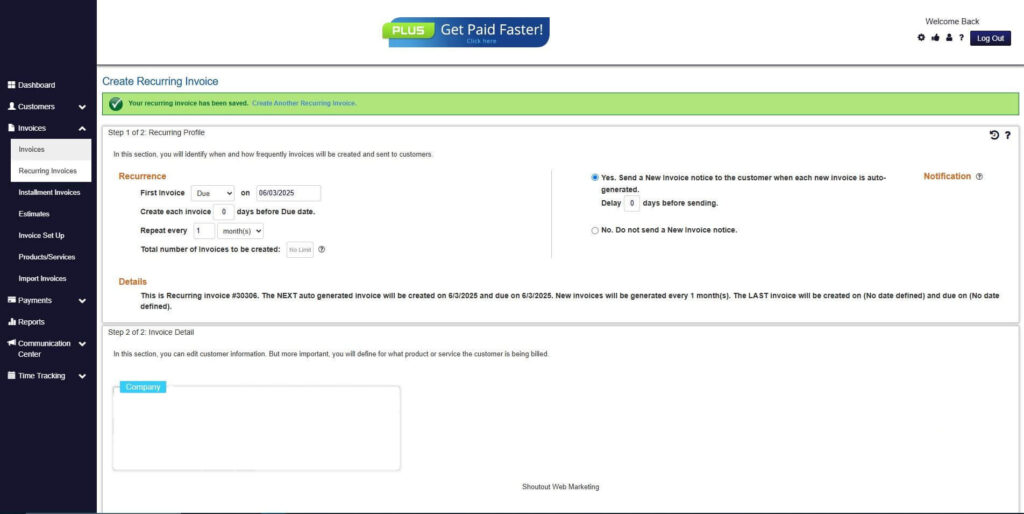

Step 9: Recurring Invoice Created

Your Recurring Invoice has been created.

Wrapping Up

No one does more to get your invoices paid than ReliaBills. For comments or inquiries, send us an email at sales@reliabills.com. You can also call our hotline at 1 877 93BILLS.