Are you struggling to find new clients to expand your business? Are clients hard to come by these days? You might either be looking at the wrong place, or you’re using the wrong strategies to get clients for your business. If you need to know how to get clients, here are six methods that will help you get more clients online. At the same time, we’re also going to teach you how to bill these clients.

Most businesses think about “getting a dozen or even more when it comes to getting clients.” The more, the merrier, right? Wrong. If you want to get that many clients, you’ll only have to get one first. That one client will turn into multiple hundreds to thousands of loyal followers for your brand. So, without further ado, here are six ways to help you get more clients online.

Table of Contents

ToggleTip #1: Craigslist

Craigslist is a long-running American classified ads website with sections devoted to sales, jobs, housing, items wanted, services, gigs, community service, forums, resumes, and more. Found way back in 1995, it continues to see relevance even today.

It now has a bad rap – and for a good reason – but it’s still a great place to find new opportunities like finding new clients online. One good way to do this is by the thing they call “Craigslist Penis Effect (CPE).” Basically, CPE is the thought that everyone else is so bad that, by being just a little bit decent than everyone else, you look a thousand times better than your competition. Let’s say, for instance; you’re sending flyers to potential online clients about your services without getting any results. If you just wrote a few thoughtful messages here and there, you’d get more and better responses from people.

You can take advantage of that exact idea to find great clients on Craigslist. If you took the time to write a great email reaching out to these potential companies, you would immediately separate your brand from 99.99% of other websites that are just sending boring, generic emails, getting them nowhere.

So, head on to the Craigslist job board for your specific niche. Here are some common hustle sites out there:

- Writing and editing

- Video production

- Web design

- Graphic design

- Software engineer

- IT support

Tip #2: Networking Events

Networking events are a nightmare – at least for some people. But the reason is that people typically go to them looking for clients. As someone looking to get clients, you shouldn’t make the creepy approach that most people are doing. Instead, you should go to networking events with a mindset of wanting to find “connectors.” These are people who may not turn out to be a client but can help introduce you to potential ones.

Now that you know you’re not going to be finding leads at a networking event, you’re not going to go in there and try to pitch your business. Instead, you’re going to find connectors to lead you to the actual clients.

Here’s a good script that you can use to connect with a potential connector:

“Hi, if you know of anyone who’s looking for a web developer, please let me know. Here’s my card. You can pass it along to them.”

You can modify this script according to what fits your individual situation.

If you live in a big city, then networking events are always around the corner. If not, that’s okay. Keep yourself posted on any upcoming networking events so you can plan ahead of time.

You can check out online event bards like the following for the best chance at landing networking events in your area:

- Meetup.com – One of the top sites for social meet-ups and networking events.

- Eventbrite.com – This site aggregates different types of events happening near you. It also has a filter for networking events in its search functions.

- Facebook – No matter what industry you fall into, there will always be a group of like-minded people on Facebook for you. In most cases, these groups will notify you of any upcoming events that you can attend.

Tip #3: Where Potential Clients Live

No, we’re not trying to promote stalking your potential clients and going to where they live (unless you want them to file a restraining order on you). Instead, you’re going to go online to the places – or sites – where your potential clients frequently visit.

Start spending all of your free time hanging out where your potential clients are online (e.g., Facebook groups, online forums, etc.). Directly engage with them by sharing valuable content that they might find relevant. At the same time, you should also answer questions that they might be asking.

That’s how you can get your first client online. Help them for free – answer their questions about whatever topic they’re finding difficulties on, and then pitch them your business that can be the solution to their problem. Nine times out of ten, they will say “yes” to whatever you say once you’ve helped them out long enough.

You can use this same framework for your potential clients.

What niche are you in? Are you a graphic designer? Find a Facebook group or subreddit for small business owners who might need your services.

Are you a content writer or a copyeditor? Start answering questions related to your niche on inquiry sites like Quora.

You might be a video editor. Find Facebook groups about bloggers who are looking to expand their media content.

No matter what profession you have right now or what you’re going to choose, you will need to make sure you stay engaging enough. Provide high-quality answers to your potential client online. By doing this strategy, you can build off your brand and make connections so you would never have otherwise.

How to Get Higher Value Clients

So, you think you’re ready to scale your business and start getting higher-level clients online? It’s incredibly simple once you’ve attained your initial three to five clients. All you need now is to remember to keep delivering incredible service to your clients. After that, it’s all going to be a breeze.

Tip #4: Getting Referrals

Referrals from existing clients are one of the best ways to get more clients to choose your business and earn more for your services.

Here’s why getting referrals is such a great idea:

- Your price will almost always rise when you get referred. A lot of online businesses and freelancers fall into the trap of keeping their rates static when they get referred, thinking that their old client told their potential client their rate (most likely they didn’t). NEVER DO THIS. Your old client added more value to your profile by recommending your work to their peers. Reflect that at a much higher rate.

- More incentive to do excellent work. Here’s another example of why you want to treat each of your clients that come your way with respect while going above and beyond to provide them some world-class service. There are always areas where you can add value to your business, and it will only help both you and your client in the long run.

- You will get higher-quality clients. If you charge more, that also means you will start to weed out the high-quality clients who can afford you from the lower quality ones. At the same time, by paying you more, they’re less likely to waste your time and money. So it’s a win-win situation for you.

- Your income will scale drastically. Referrals will double your earning capacity and will help your business reach a new level of earning. It’s a massive win once those referrals will also refer you to other people. This method escalates, which will only give you twice the earning power.

Referrals are a great way to start charging more for your services. It allows you to increase your rates, as well as gain more customers.

Tip #5: Cold Email Potential Clients

Cold emails are nothing to be scared of. You can use them to attract potential clients effectively. This type of email is the perfect way to snag a client for three good reasons:

It will show the client that you know them. Nothing’s going to make a potential client trash your email faster than a generic, boilerplate message. Instead, showcase how much you know this person and how you’ve helped them (don’t forget to make some serious complements.

It shows that your company cares. Let’s face it: you’re a busy person. That’s why you need to take that personal care. If you and the person you’re emailing have a warm and active connection, make sure you mention that in the message. You can also do what this guy did and tough on a subject that matters to that person.

Make it easy to say yes. The reader to who you’ll send your cold email should know what you’re after. That’s why send them a pitch that will make them say yes in any circumstance. That way, no matter what their mood is going to be when they open your email, the results will almost always be the same, which is a yes from them.

By using cold emails to market your business, your potential clients online will be clamoring for the phone to call you the time they finish reading your email. You can use this framework to reach out to potential clients that you don’t know.

Tip #6: Industry-specific Job Boards

An excellent place to find potential clients online who know exactly what they want are industry-specific job boards. In this option, you will find clients willing to pay top dollar for the service they are seeking.

These job boards are specific to certain industries that can help generate great leads. If your business is niched down enough, you will find clicks from many job boards. Here are a few great industry-specific sites that you can check out for your leads:

- Developer/Engineer: Engineering.com, iCrunchData.com, SmashingMagazine.com, Toptal.com

- Illustrators/Designers: Designs.net, 99designs.com

- Healthcare/Pharmaceuticals: HealthcareJobSite.com, AllPharmacyJobs.com

- Media/Publishing: JournalismJobs.com, MediaBistro.com

- Non-profit: CommonGoodCareers.org, Encore.com, Idealist.com

How to Bill Clients in 5 Easy Steps

Now that you know how to find clients online, it’s now time to understand how to bill them properly. You might already have a billing process running. However, if it doesn’t follow this process, then chances are, it’s not going to last long. You need a foolproof system that will allow you to bill your clients and get paid on time. With that said, here are five easy steps to bill your clients.

Step 1: Refer to the Contract

Most good business-to-client relationships are based on a contract template. Whether you create one, the client provided it, or collaborated on a contract incorporating both parties’ feedback; a contract document is the starting point for billing practices. Your agreement should have outlined the essential details you will need to refer to in your invoice.

It will also guide you on the proper billing amount. That way, your pricing will be just right. Your contract might even include extras such as who the invoice template gets addressed to and how payment will be made. Suppose your contract is missing an important component necessary to bill your clients.

In that case, you will need to go back to the client now – before your first invoice – and get some clarification to avoid any misunderstanding. It would be good to have these new details in writing via a contract addendum or new legal agreement. If nothing else, a simple email where you both type out “I agree” in response to the payment terms will be sufficient enough.

Step 2: Create an Invoice Template

Since every client will have a slightly different preference for how they want to be billed, it’s best to set up each first-time invoice for a client as a unique template that’s made specifically for them. That way, it will be easier to duplicate the original invoice (complete with billing contract, address, payment terms, etc.) and update the project details (such as the hours tracked on your timesheet or online tracker) and the amount due.

ReliaBills has a guide on making an invoice of all sorts found on our official blog page. Every article has all the details that you will need to know and include in your invoice. For larger corporations who require extra billing details – e.g., internal line-item reference cords or PO numbers – an invoice template will serve as the simplest way to save time on what could be a lengthy process every month.

If you want to create an invoice from scratch, you can do so on the ReliaBills platform. Simply create a free account, and you’re all set.

Step 3: Make it Easier to Pay

The majority of invoicing services work with third-party payment processors like Stripe or PayPal to get you paid for services directly from the invoice. This option offers a significant advantage to businesses and companies that want to appear professional and cut down on time between sending out an invoice via email and receiving payment. By giving clients a one-click payment solution and asking for payment in an email, there’s little to no chance that they will forget to pay you or send the money to the wrong account or contact.

If you accept payment by check, make sure your invoice includes everything your client needs to send it. Who should the check be made up to? If your business name is different from your bank account name, make sure your invoice indicates so. If you accept Zelle, Chase Payments, or other available P2P payment services, include a line about which payment email money should be sent.

Note: Invoices paid with cryptocurrencies are generally more likely to be paid late. So, if you accept this form of payment, think carefully before accepting them.

Finally, if you prefer direct debit payment from your checking or savings accounts, this will usually require to be set up before sending your first invoice. Discuss the possibility with the client while in the contracted phrase. You’ll be asked to provide a copy of a voided check or your bank account’s routing and accounting numbers to have this payment option set up. Make sure you give this information only to a trusted client. You may also have this option become active once you have been paid a few times and have some level of trust and confidence with the client.

Step 4: Send Invoices Promptly

Every client will have a payment schedule that’s unique to them. What this means is that you will need to send out invoices to meet that payment cycle. Do they only send out payments once a month? Know what the cut-off dates are to send invoices so that you will get paid on time. Are they open to invoices at any time or after each project or milestone completion? Know if it’s okay to send invoices as work progresses and how they feel about billing multiple times in a payment cycle.

Also, determine how they handle outstanding invoices. If you bill every 30 days, for instance, and payment from an earlier invoice hasn’t been settled in time for the subsequent invoice to go out, will you add the totals together? If so, make note that the first amount is being carried over. You can label this as “balance forward.” You wouldn’t want to confuse their accounting department by billing multiple times for the same amount due.

The sooner you send out an invoice, the sooner you’re likely to be paid. Keeping cash flow constant depends on your ability to keep invoices current. If you are lazy about creating and sending new invoices, you will soon find yourself not getting paid in a timely fashion. If you’re billing your clients via email, a solid invoice template can go a long way.

Step 5: Follow-up with Late Payments

Finally, you should always make follow-ups on late payments. The great thing about contracts is that they usually only have to be referred to for results to happen. If you’ve waited for 30 days from invoicing without receiving payment – and your contract promises “net 30” for all invoices, you now have the right to contact your client and inquire about payment. You don’t have to be rude when checking in. A simple “I just wanted to ensure you got my invoice and see if you have any questions” should be perfect.

Some invoicing tools also include a “reminder” button that you have to click to send a pleasant follow-up note. Most clients are embarrassed by the idea of not paying their bills on time, and that is usually enough to get payment coming your way.

BONUS: Switch to Automated Recurring Payments

At its core, recurring payments is already a formidable and effective billing model that you can use to improve your business’s cash flow. But if you’re looking for an even more efficient and profitable way to manage your recurring payments, automating your recurring payment system is the key.

Several benefits come with automating your recurring payments:

- Automation ensures timely and consistent billing – no missed or late fees.

- Automated systems help you identify issues early and resolve them before they become more significant problems.

- Automating your billing enables you to reduce risks and liabilities, including risk from fraud.

Since recurring payments are automated by nature, it’s a lot easier to monitor their performance than manually managed ones. You can see each transaction’s status on an ongoing basis with little effort or cost required on your part. With the correct tools in place, you can even automate your recurring payments to adjust to certain conditions, like changes in customer credit risk score or account status.

So if you’re looking for a more efficient and profitable way to manage your recurring payments, it’s time to switch to automated recurring payments.

Recurring Billing Frequently Asked Questions

Is my business fit for recurring billing?

To determine this, you must first ask yourself: Is my business able to offer multiple products and services?

If yes, then recurring billing is for you. Larger businesses are usually the better candidates for a system based on subscriptions because of their customer base. Your product or service should have some durability so that when customers purchase your item, they will need to buy it again in the future.

Can I send invoices with recurring billing?

Yes, you can set up your plan. That way, when customers are billed and payment is due, an invoice automatically goes out reminding them of what they’re paying for. At the same time, it also reminds them why they should still be paying attention even though they haven’t paid.

Some of our customers like to set up their invoices as a subscription reminder, and others prefer to send it out at the end of each month saying something along the lines of “you will be billed again on …..for what you have been paying for this whole time….to cancel your plan please email us at xxx@xxxx.com”

Can I offer a discount for those who pay annually?

Yes, you can give discounts to customers that choose to pay for an entire year of service in advance. You could also reward your long-standing customers with a loyalty program that offers them perks like this. It’s up to you to decide what would work best for your business.

Can I change my plan later on if needed?

Yes, you can. When you use an invoicing platform like ReliaBills, you can always upgrade or downgrade your plan depending on the needs of your business. For example, if you are a small business and suddenly experience customer growth, you might want to consider upgrading to ReliaBills PLUS and take advantage of its recurring billing feature. Or, if you are a more significant business and see that you are not using all of the features in your current project, you can downgrade to the basic plan with fewer features.

Automate Your Invoices With ReliaBills

As the popularity of recurring payments grows each year, more and more payment processing solutions are popping up to help businesses automate their billing. So, with that said, why ReliaBIlls? Well, if you’re looking for a reliable and easy-to-use solution, ReliaBills is an excellent option.

With ReliaBills, you can easily create and send invoices, set up recurring payments, and manage customer accounts. Our basic plan is available for free, while our premium version, ReliaBills PLUS, is available for only $24.95 per month. Visit the official ReliaBills website now for more details.

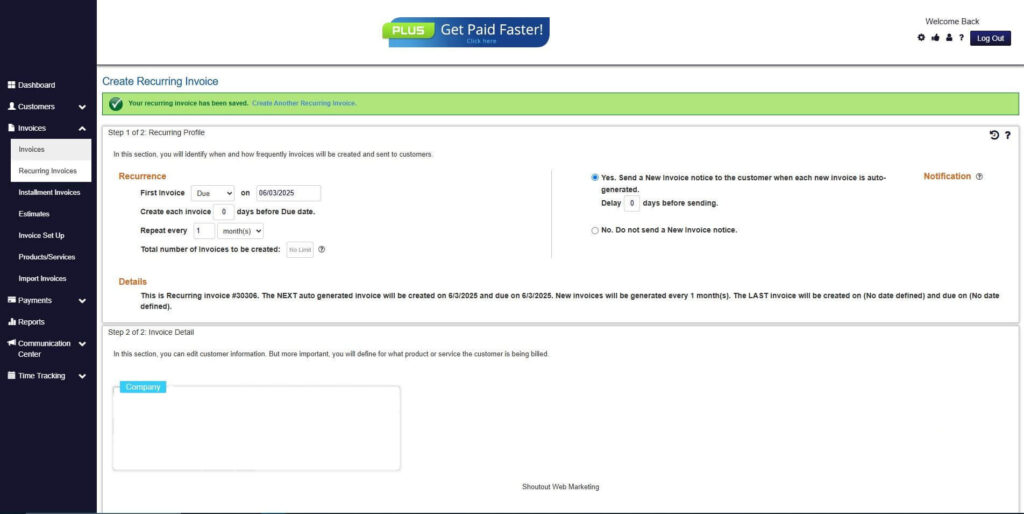

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

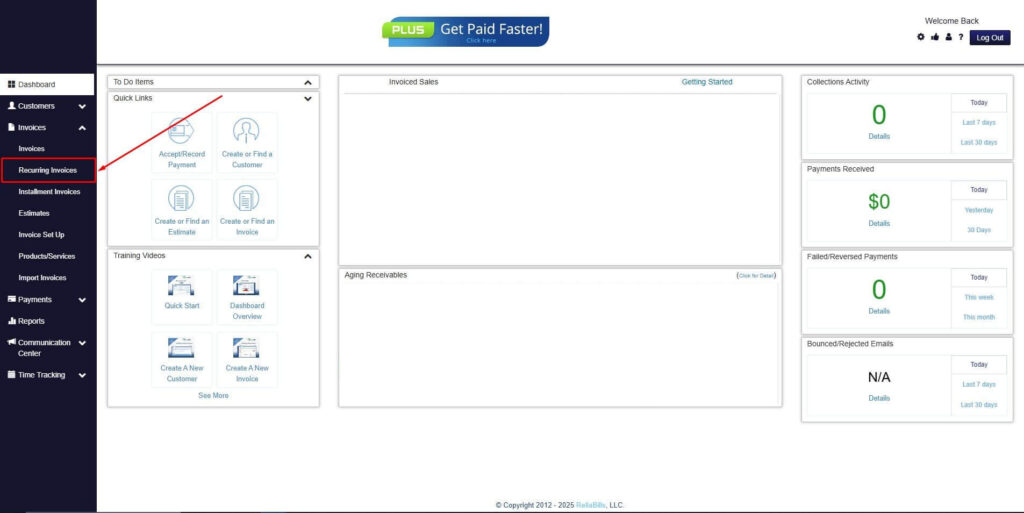

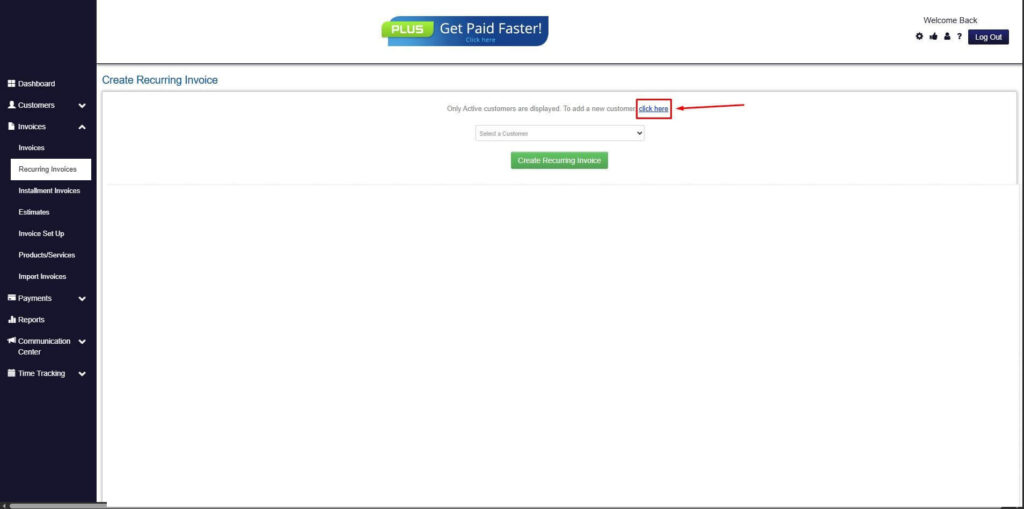

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

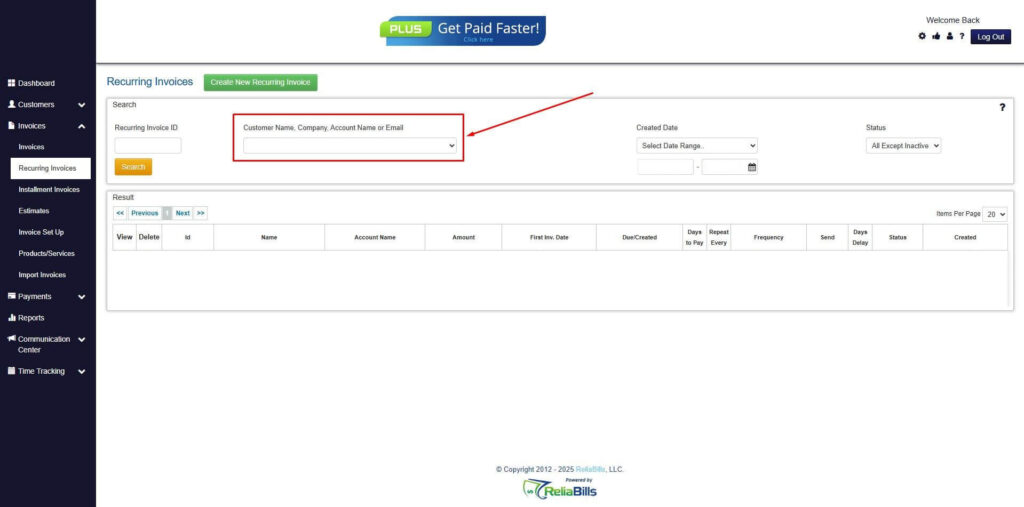

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

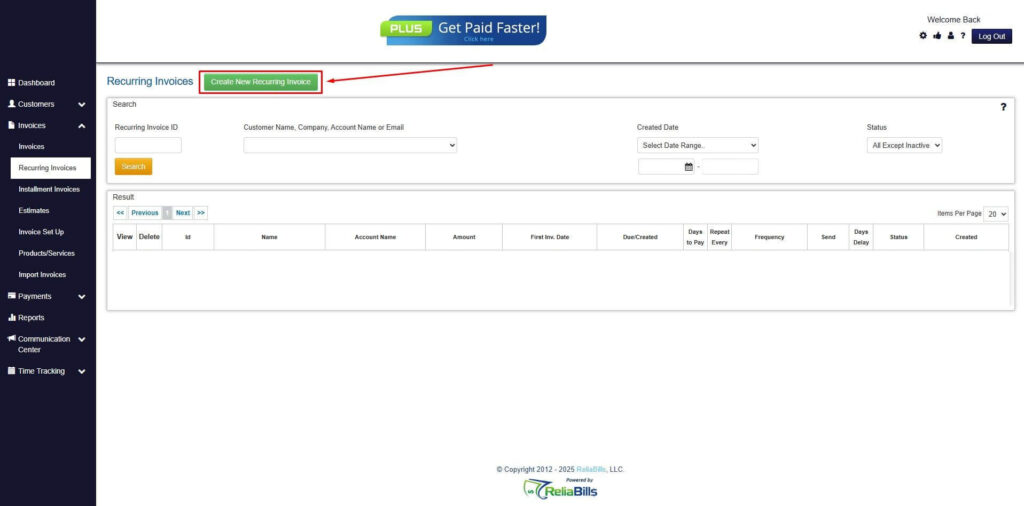

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

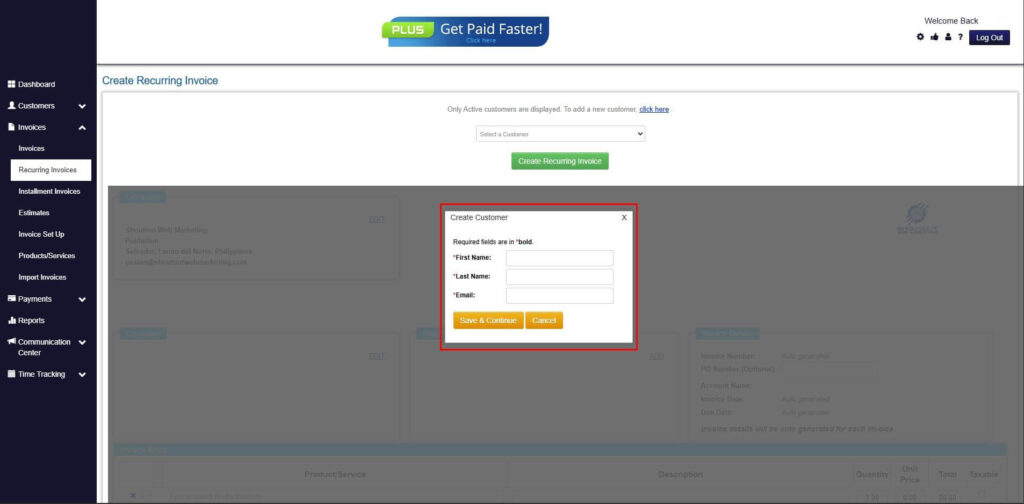

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

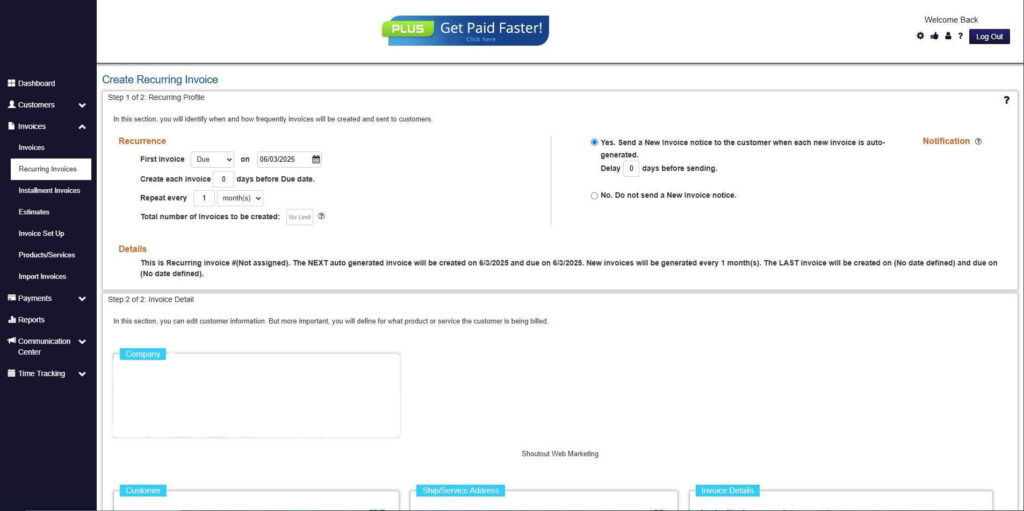

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

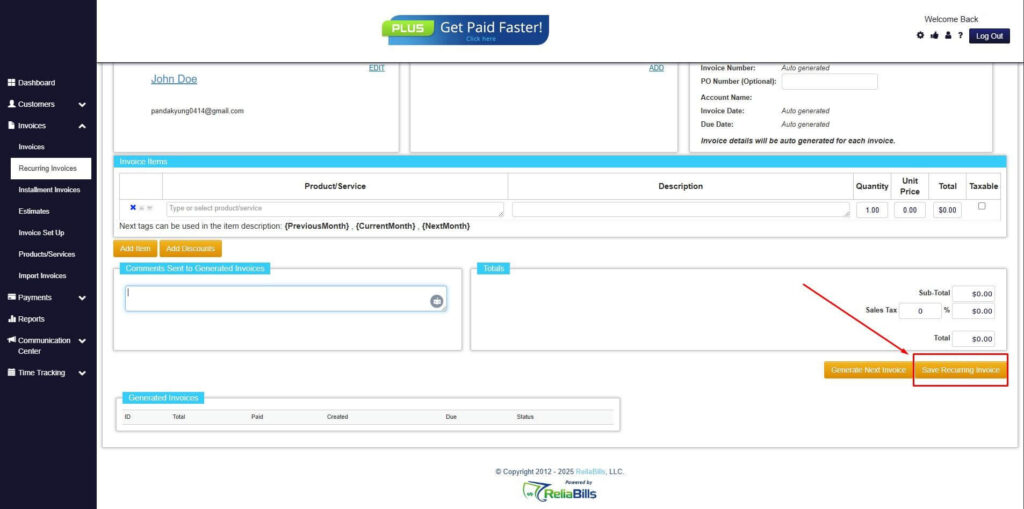

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Wrapping Up

These are all the information you need on how to get clients online and bill them properly. Keep in mind that each strategy outlined in this article is proven-tested to work as many successful companies use them. So don’t hesitate to use this as a reference on your goal towards success in whatever industry you do business in. Good luck!