Are you a freelancer? Do you work and earn from the comforts of your home? Becoming your own boss and working at your schedule may be the best decision you ever made. You have the opportunity to choose your clients and projects that you like, hone your skills, set your schedule the way you want it, and even set your own rates.

There’s nothing more fulfilling than receiving money for all of your labour. You’ve also achieved the work-life balance that you’ve always wanted. Don’t think that it’s all going to be smooth sailing from here. There will be challenges –especially at the beginning. It may seem like a hectic job organizing your business and life. However, you’ll eventually adapt and get the hang of things moving forward.

As for the billing aspect, there have always been some mixed reviews on how to manage client invoices. According to recent studies, 27 percent of small- to medium-sized businesses have a hard time creating and sending invoices.

That’s also the reason why many businesses are now taking advantage of automated invoicing platforms like ReliaBills. Sending a bill to clients can be tough at first for startups. But keep in mind that you’ll eventually get the hang of things. Once you have a proper invoicing system in place, you can invoice customers easily.

Then, some struggle with the entire process and end up with constant payment delays. To put that into perspective, small businesses in the United States spend an average of 61 ways waiting for pay.

If you’re running a freelance or startup business, you need to be aware of this issue. Many small businesses shut down and succumb to bankruptcy due to delayed invoicing. That’s why in this article, we’re going to help prevent that from happening to you. We’re going to teach you how to bill a client and get paid effectively.

Table of Contents

Toggle#1. Create a Contract Agreement

Once you’ve come to terms with a potential client, the first thing you need to do is create a contract agreement. It’s okay to start with a verbal agreement – especially when it’s an urgent project. However, you will still need to get something down on paper for documentation and legal purposes. A contract agreement should feature both the project and the payment terms. That way, you have all the necessary evidence once things don’t go well along the way.

Keep in mind that your word against theirs won’t be enough evidence if both parties end up in civil court due to non-payment. That’s why you should create a clear and detail-oriented contract that outlines the services you’re offering and the corresponding rate that the client has agreed to pay you. In addition, you should include guidelines on the due date for invoices sent.

For example, you can have the invoice due on receipt or do a NET 10, 30, or 45, which corresponds to the days that the client needs to pay. What you choose will depend on the project type and the decision of the client. That’s why it’s best that you also involve the client in this process. That way, they can choose a plan that meets with their finances. That also means you will end up with different payment plans for each client that you have.

Once you have a solid contract in place, use this as the basis for creating your invoices for that particular client. That way, you will bill them the right way, and they will always be mindful of any invoice coming from you. That way, you can bill your client knowing that you have one of the best methods for getting you paid on time.

Keep in mind that you will have different contract agreements for each of your clients. So always review them to make sure you’re not missing anything.

#2. Use a Template When Creating Your Invoices

Since you’re a freelancer and not affiliated with any company, you’ll need to create your invoice. Creating an invoice from scratch can be very time-consuming. That’s why you should look to cut down the time that it takes to create one. An effective way to hasten the billing process is to have an invoice template in place.

You can either create this yourself using desktop software, or you can use an automated billing system like ReliaBills to do this for you.

The ReliaBills invoicing platform lets you customize and create invoices that are unique to your brand or company. All you need is to create a FREE account, choose your desired template, fill in the blanks, and submit your invoice.

If you’re billing your client regularly, it’s best to keep specific details in the cloud. That way, all you need is to change the date or adjust the price. The invoice number will also change per invoice you create.

You can also schedule your invoices in the options menu. That way, it will automatically send to the recipient at the right date and time. This will guarantee that you will be paid on time.

#3. Simplify the Payment Process

You simply can’t expect your clients to pay on time you if you’re not giving them options for payment. That’s why it’s essential to offer multiple modes of payment. That way, any bill that is due for payment will be done in multiple ways. Your clients will also appreciate the convenience.

For example, if you only accept PayPal, you need to expand that by offering other payment options. You can include Stripe, TransferWise, debit cards, credit cards, and maybe even direct bank transfers. That also means you’ll need to partner with third-party processors to make all of that possible. Keep in mind that when it comes to credit cards, you will need to make sure that the card they used isn’t expired. The entire payment plan is laid to ensure that invoicing customers and sending an invoice to a client won’t be as hard for you. With a variety of payment options, you can bill your clients without having to do too much.

Keep in mind that your bank account needs to be updated regularly. You should also have a different bank account that’s exclusive only for receiving payments. That way, you can start billing clients and grow your cash flow in the long run.

However, instead of going through all of this, you can quickly get paid by using ReliaBills. Using our dedicated invoicing system, you’ll be able to accept both plastic and platform payments. By using our automated invoicing system and integrating your payment options to it, your clients won’t have to transfer to different platforms to pay you. Everything is done in a single, safe, and secure digital space.

ReliaBills will be responsible for sending your invoices and notifying you if payment has been made. That way, you will get paid on time and with less hassle. It’s quick and easy, which also entices clients to do business with you more since paying you is convenient.

Always keep in mind that longer and harder processes will put off anyone from doing business with you again. Others might continue but will delay their payments. If you don’t want that to happen, you should have a secure payment method in place.

#4. Never Think Twice About Sending Out Invoices

This one might seem like common sense, but there are a lot of freelancers out there who are hesitating about asking for the pay. It’s quite mind-boggling how some people delay their invoices until their clients forget to pay them completely. How can you expect to get paid on time if you’re not even sending your invoice promptly? If you wait too long, you will risk your clients forgetting about your project and the payment that they owe you. What’s worst is that they might even look for other people who are more active in giving out updates.

If you’re someone who delays their invoice, you’re depleting your reputation with your clients. Once your invoice pops up in their inbox, they may brush it aside since they’re too preoccupied on their next project. In addition, whatever plan you have in place will prolong the process even more.

For instance, if you give a client around 30 days to pay, it will begin on the date that you send the invoice. So by waiting for 10 days to send your invoice, you’re now pushing the possible pay date to 40 days from the time the project was completed. That’s an incredibly long time and will encourage the client to put off your invoice until the last few days of that duration.

Some companies have a 30-day billing cycle. So if your complete tasks daily or weekly, then consider asking them if it’s okay to bill them multiple times throughout the month.

As a freelancer, you’d want to get paid faster and more frequently so you can cover your business and personal bills. That’s why you would want to have a pay cycle in place. That way, you will have a steady flow of money coming into your business. Keep in mind that it will start with your contract and your ability to send out your invoices promptly.

#5. Don’t Hesitate to Make Follow-Ups

The freelance world is full of uncertainty and unpredictability. There will be times when you come across a problematic client who always sends out their payment late. You’re also going to run into clients are always forgetful of the payment that they owe to you.

If this is a first-time client or an invoice that was missed by an old client, you should reach out to them to find out what happened. Never make assumptions about a delayed payment.

Maybe an emergency occurred that they had to tend to right away. Maybe they just simply forgot about it. Whatever the reason is, it’s crucial that you follow-up on payment so that the amount will be compensated. Sending a follow-up email inquiring about the late payment can help remind or push them to pay the invoice that they missed.

However, if you’ve send several follow-up emails, and you’re not getting a response from them, then you’ll have to kick things up a notch. You can reach them out through phone call, or send them a notice detailing that failure to pay the delayed payment will result in legal actions.

The worst-case scenario is that you’ll end up in civil court over late payments and fees. Whatever the situation may be, the goal is always to get you paid. So do everything you can to so that no invoice will be missed. Make sure that you refer to the payment terms for any delays on the invoice to be paid. Sending invoice should also be taken seriously for both you and your clients. Keep in mind that a single late payment can significantly affect your income. So always have a payment schedule in place, different modes of payment available, and the contact information of your client to so that you will know where to find them.

#6. Incorporate a Recurring Billing Strategy

If you want to get paid effectively, you should transition to a recurring billing strategy. This type of billing model gives you a lot of flexibility and convenience since you’re automating your entire billing process from start to finish. With ReliaBills, you can set up recurring payments to get paid automatically, depending on your chosen billing cycle.

With a recurring billing feature, you won’t need to reach out to your clients for late payments, take cards over the phone, or manually re-entering the same payment info every month. It simplifies your entire billing process and makes it easier for you and your customers. If you choose ReliaBills, you can enjoy its recurring billing feature for free. Our competitive rate ensures that you get paid fast and one time.

ReliaBills is a popular choice for businesses like you who want to get paid. We offer a safe, secure, and easy recurring billing option for you and your customers to enjoy.

What is Recurring Billing?

Recurring billing, otherwise known as recurring payments, is a payment processing model that lets merchants automatically charge their customers’ credit cards for the goods or services they provide. Automated payment is made on a prearranged schedule. Recurring billing will require the merchant to obtain a one-time consent from the customer to charge their card on file on an ongoing (recurring) basis until the customer withdraws permission (e.g., when they cancel their subscription from the business).

Setting Up Recurring Payments

Are you unsure about how to set up recurring payments on ReliaBills? Don’t worry! The process is straightforward. First, you’ll need to create a free ReliaBills account, and you’re all set. If you want more features such as QuickBooks Sync, auto collection notifications, automated failed payment recovery, and more, you can upgrade your account to ReliaBills Plus for only $24.95 per month.

NOTE: It’s considered best practice to have your customer sign a credit card authorization form before charging their card on file. That way, you’ll minimize the chances of misunderstanding or mistakes during the payment process. You can search for credit card authorization form samples online.

ReliaBills is one of the leading online invoicing and recurring billing software that will help you get paid on time. If you’re interested and want to try out our amazing system, see our affordable pricing here.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

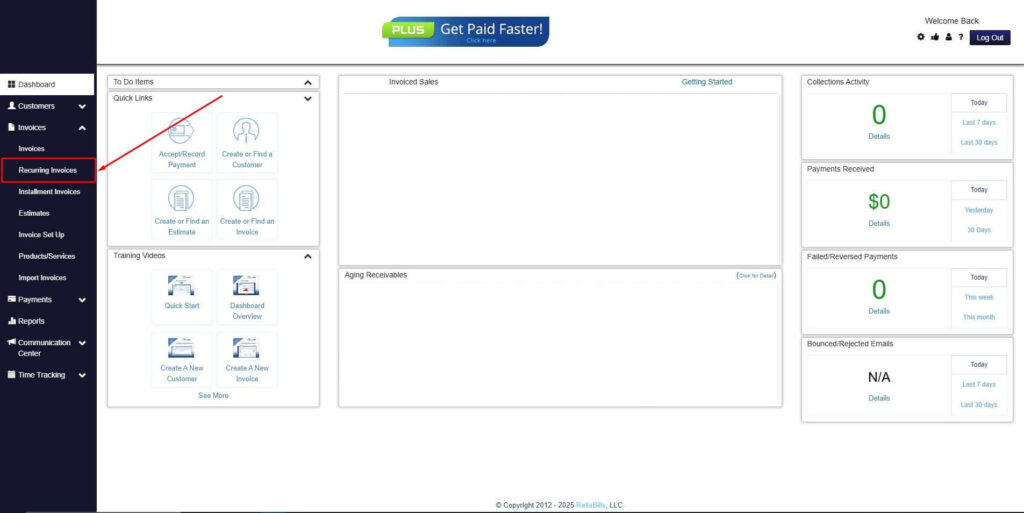

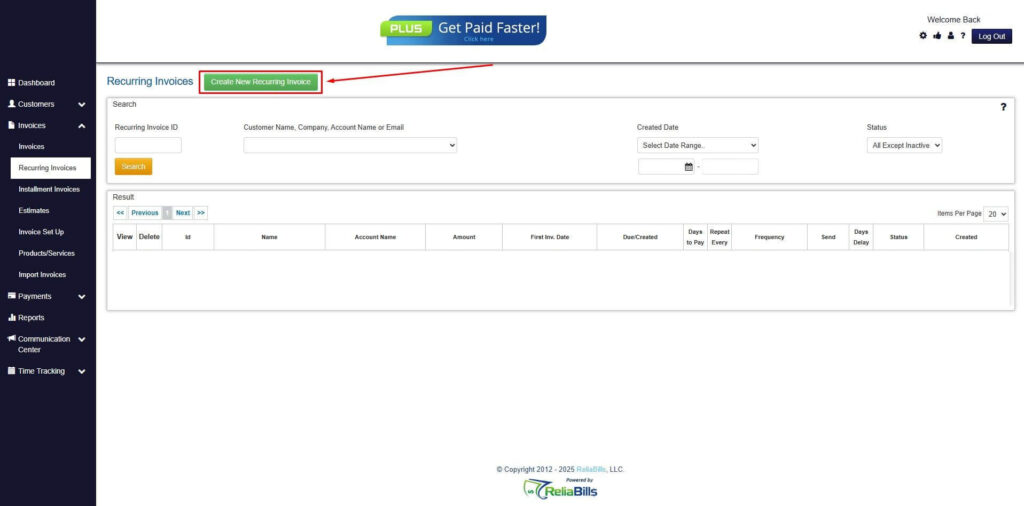

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

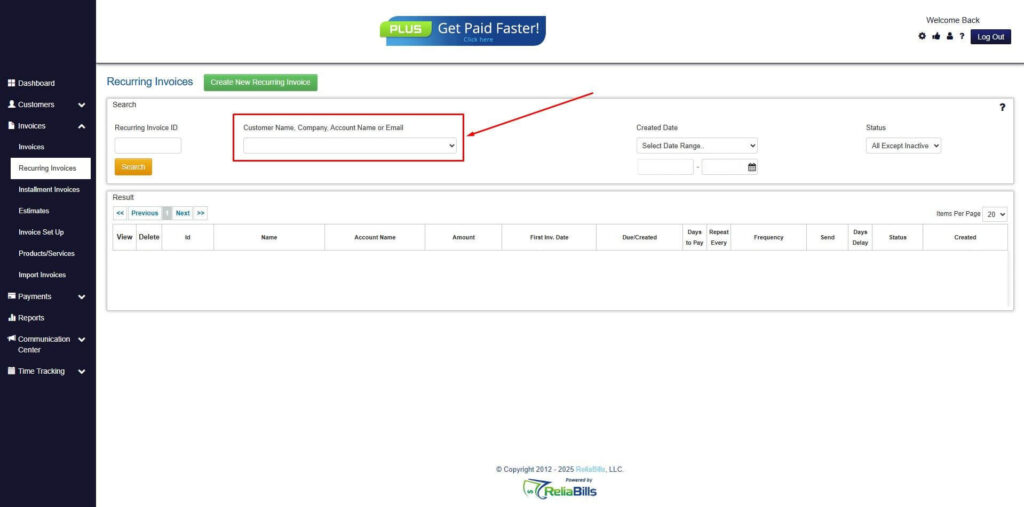

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

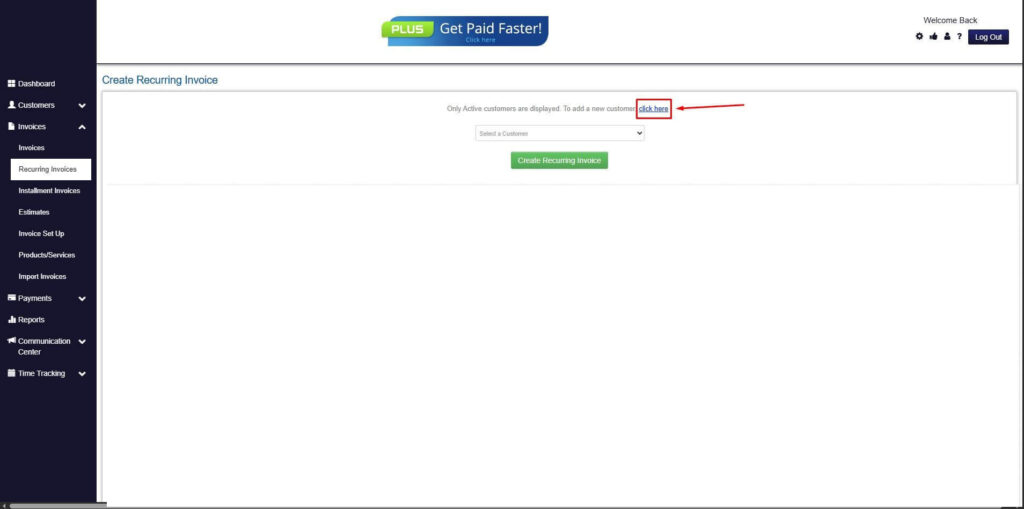

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

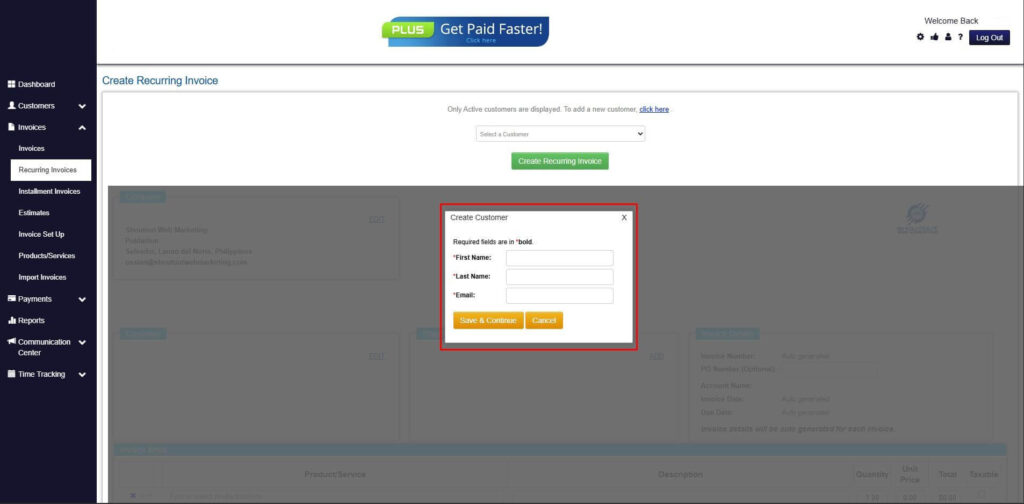

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

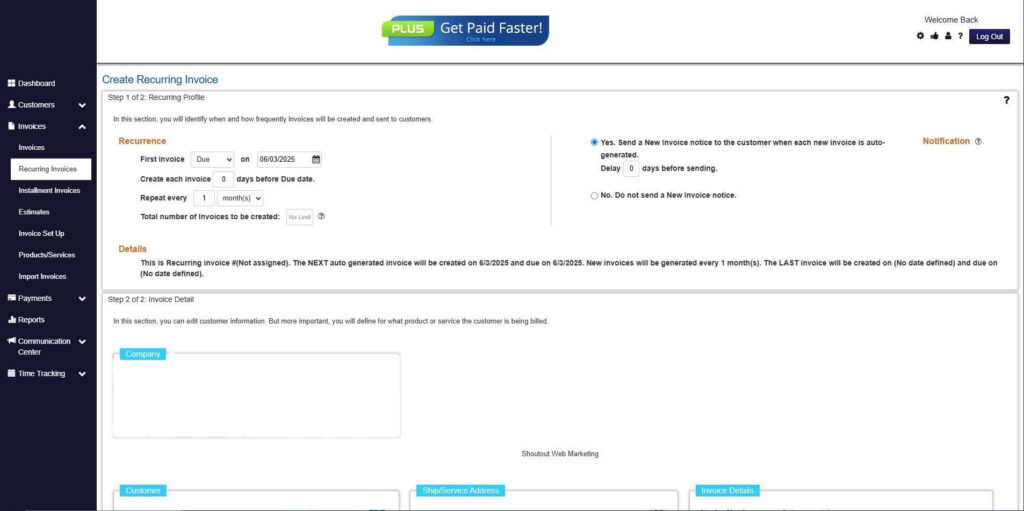

Step 7: Fill in the Create Recurring Invoice Form

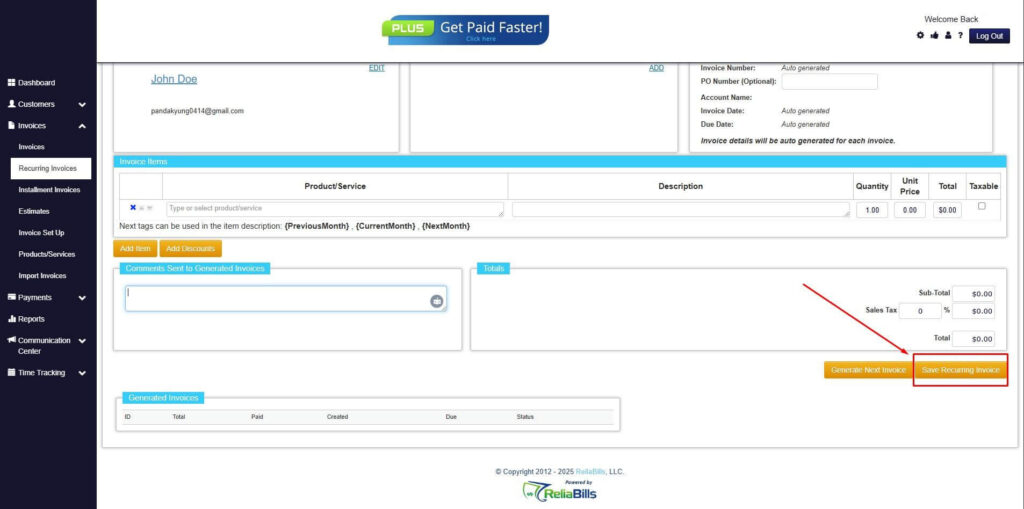

- Fill in all the necessary fields.

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

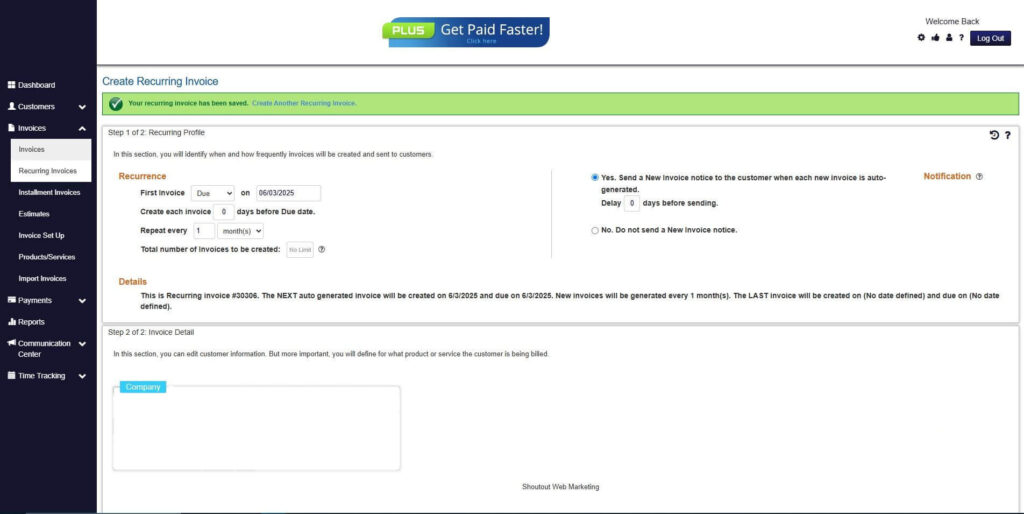

Step 9: Recurring Invoice Created

Your Recurring Invoice has been created.

Be A Professional in Billing Clients with ReliaBills

If you want to be taken seriously by your clients, you need to be an absolute professional in your communication, delivery and invoicing. With ReliaBills, you can make all of that happen and get you paid on time. ReliaBills will automate everything for you so that you won’t have to worry about anything. The system will send out invoices on the set date and notify you once payment has been made. Payments will be cone once you’ve completed a project. The project details will make sure that you don’t skip a beat, so check that out regularly