Like most people, you probably use direct deposit for your paychecks. It’s fast, convenient, and secure. But did you know that you can also use direct deposit to pay your invoice and bills?

Yes, it’s true! You can set up a direct deposit for just about any invoice, from your rent to your utilities. And it’s not just limited to businesses—you can use direct deposit for personal invoices, too.

So how does it work? This article will show you how to set up direct deposits for your invoices. We’ll also explain the benefits of using this payment method and tell you what to do if there’s a problem with your invoice payments. So read on to learn everything you need to know about direct deposit invoices!

Table of Contents

ToggleWhat is a Direct Deposit?

Direct deposit is a type of electronic transfer of funds from one bank account to another. It’s a safe and convenient way to receive payments, and it’s often used for payroll and government benefits. With direct deposit, your employer or payer will deposit your payments into your bank account electronically.

You can also use direct deposit to pay your bills and invoices. Setting up direct deposit for your invoices will mean the payer sends your payments to your bank account instead of mailing a check or sending a payment through an online bill pay service.

Direct deposit has become a very common payment method in recent years, with nearly 94% of US workers receiving their paychecks via direct deposit in 2019.

How Does Direct Deposit Work?

Setting up direct deposit for your invoices will require you to provide your payer with your bank account information. This includes your bank’s routing number and your account number. The payer will then send your payments to your bank account using this information.

An employer starts the process by collecting the bank information of its employees and vendors. This information should be among the things your employer has likely gathered from you during your onboarding process.

For example, an employer starts processing payroll payments bi-weekly (15th and 30th of the month). In general, the company will send its payroll instructions to its bank one or more business days before payday, which will then pass that information to the ACH (automated clearing house). The ACH operator will sort the ACH entries and ensure that each instruction is routed to the correct financial institution for each employee’s paychecks.

After receiving the ACH instructions, the employee’s banks will then process the payment and credit their account with the corresponding funds. Direct deposit usually processes for one or two business days.

Steps to Setting Up Direct Deposit

A direct deposit setup is always the same, regardless of the payer. With that said, here’s the process that you will follow to set up direct deposit for your invoice:

- Fill Out a Direct Deposit Form: The first step is to fill out a direct deposit form. This form will ask for your bank account information, as well as your Social Security number or employer identification number (EIN). The payer will use this information to set up direct deposits for your invoices.

- Include Your Account Information: In addition to the information on the direct deposit form, you’ll also need to provide your bank account number and routing number. You can find this information on your check or by logging into your online banking account.

- Deposit the Amount: Usually, the deposit amount will equal the amount of your check. However, you may have the option to deposit a percentage into your checking account and another into your savings (e.g., a paycheck).

- Attach a Voided Check or Deposit Slip: In some cases, the payer may require you to include a voided check or deposit slip with your direct deposit form. This is to verify that you have provided the correct bank account information.

- Submit the Form: Once you’ve completed the direct deposit form, you’ll need to submit it to your payer via email.

It’s important to note that you may need to provide a voided check or deposit slip when you submit the form. This is to verify that your bank account information is correct.

How Long Does It Take?

How long does a direct deposit take, exactly? As the name suggests, direct deposit is a quick way to receive your payments. In most cases, it will take one or two business days for the funds to appear in your account.

However, there are a few factors that can affect the timing of your deposit. For example, if you’re paid on a Friday, Saturday, or Sunday, your deposit may not go through until the following Monday. The reason for this is because banks are closed during the weekends and holidays.

Another factor that can affect the timing of your deposit is the payer’s bank. Sometimes, the payer’s bank may not process direct deposit payments on the same day they’re received. This means that it could take an extra day or two for the funds to appear in your account.

If you need access to your funds immediately, you may consider another payment method, such as a paper check or a prepaid debit card.

Benefits of Direct Deposit

There are a few key benefits of using direct deposit for your invoices. Here are some of them:

Speed

The most obvious benefit of direct deposit is that it’s very fast. In most cases, you can expect the funds to appear in your account within one or two business days. This is much faster than other payment methods, such as paper checks, which can take up to a week to arrive.

Convenience

Another benefit of direct deposit is that it’s very convenient. You don’t have to worry about going to the bank to deposit a check or waiting for the mail to arrive. Instead, the funds will be deposited into your account automatically, and you can use them right away.

Security

Direct deposit is also a very secure way to receive your payments. When you get a paper check, there’s always the risk that it could get lost or stolen. With direct deposit, the funds are transferred directly into your account, so there’s no risk of them getting lost or stolen.

Direct Deposit vs. Check

There’s a stark contrast between direct deposit and check regarding security. With direct deposit, the funds are transferred directly into your account, so there’s no risk of them getting lost or stolen.

With a check, on the other hand, you have to physically deposit it into your account, which leaves room for error. If you misplace the check or it gets stolen, you could be out of luck.

Direct deposit is also a much faster way to receive your payments. In most cases, the funds will appear in your account within one or two business days. However, a check can take up to a week for the funds to become available. So, if you need access to your funds right away, direct deposit is probably the best option.

How to Set Up Direct Deposit Invoice

Now that you know all about direct deposit, you’re probably wondering how you can set it up for your invoices. Again, the process is very simple. In most cases, you’ll need to fill out a direct deposit form and submit it to your payer.

The direct deposit form will ask for basic information about you, such as your name, address, and Social Security number. You’ll also need to provide your bank account information, including the routing number and account number. Once you’ve completed the form, you can submit it to your payer.

It’s important to note that you’ll need to set up direct deposits for each layer separately. So, if you have multiple clients or employers, you’ll need to fill out a direct deposit form.

Once your payer has processed the direct deposit form, the funds will be deposited into your account automatically. In most cases, you can expect the funds to appear in your account within one or two business days.

Why Use ReliaBills Instead

Sure, direct deposits are great. But direct deposit still requires manual work, which isn’t ideal in today’s fast-paced world. What’s even better is when you can get paid without having to do anything. That’s what ReliaBills can bring to the table.

ReliaBills is a premier invoicing and payment processing system capable of automating your entire billing process from start to finish. With ReliaBills, you can get paid faster and easier than ever before.

ReliaBills lets you establish a recurring billing system, which is the more convenient and effective way to bill your clients. With recurring billing, you can set up your invoices to be automatically generated and sent on a schedule that works for you. That way, you can focus on running your business instead of worrying about billing.

What’s even better is that ReliaBills can automatically process your payments, so you don’t have to worry about it. Just sit back and relax while the funds are deposited directly into your account. All you need to do is enroll your customers in AutoPay, and our system will handle the rest.

Not only is recurring billing convenient for you, but it’s also enticing for your customers. They’ll appreciate the convenience of not having to pay their invoices each month manually. And, because they’re on a schedule, they’ll be less likely to forget to make a payment.If you’re looking for a way to streamline your billing process and get paid faster and easier, look no further than ReliaBills. With our system, you can get the most out of the direct deposit and make your life a whole lot easier. Visit our website at www.reliabills.com to learn more.

How to Create a New Direct Deposit Invoice Using ReliaBills

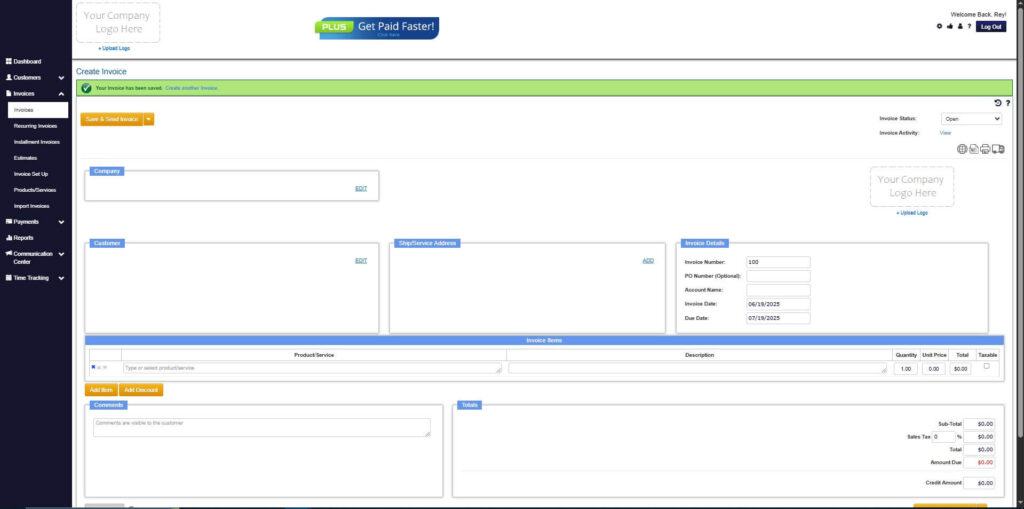

Creating an invoice using ReliaBills involves the following steps:

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

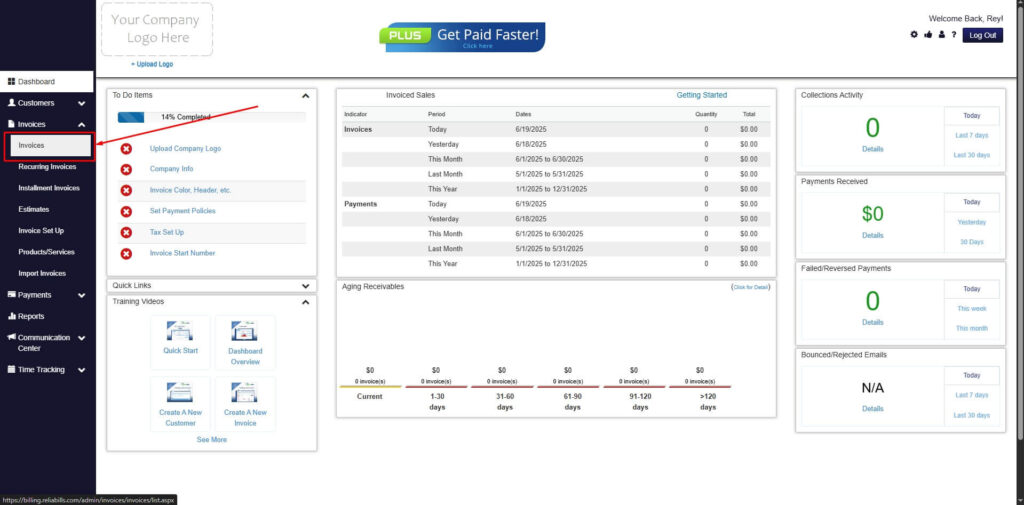

Step 2: Click on Invoices

- Navigate to the Invoices Dropdown and click on Invoices.

Step 3: Click ‘Create New Invoice’

- Click ‘Create New Invoice’ to proceed.

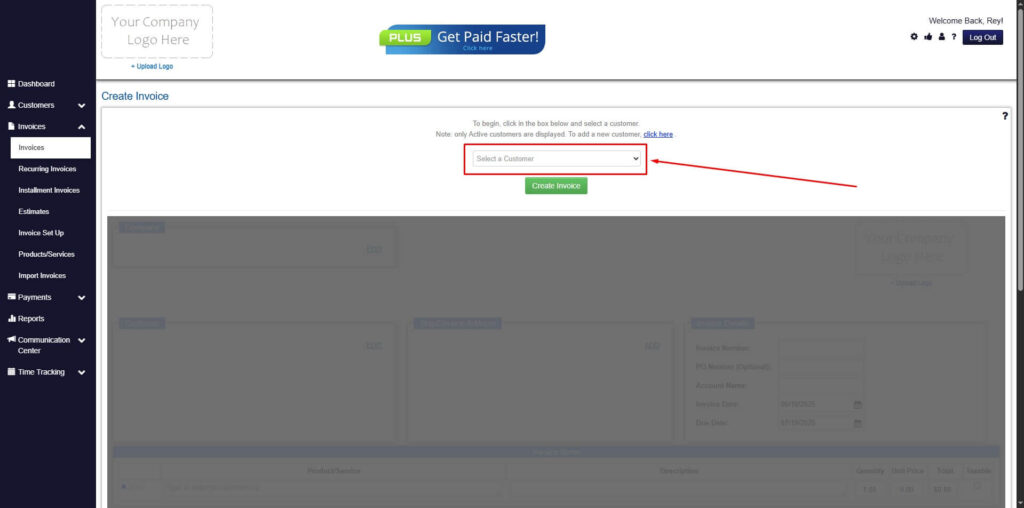

Step 4: Go to the ‘Customers Tab’

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 5: Create Customer

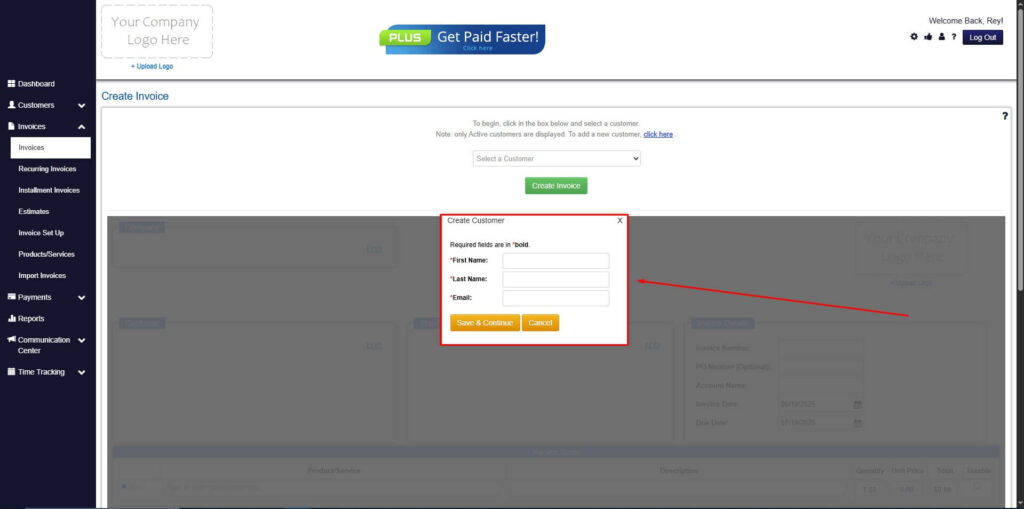

- If you haven’t created any customers yet, click the ‘Click here’ to create a new customer.

- Provide the First Name, Last Name, and Email to proceed.

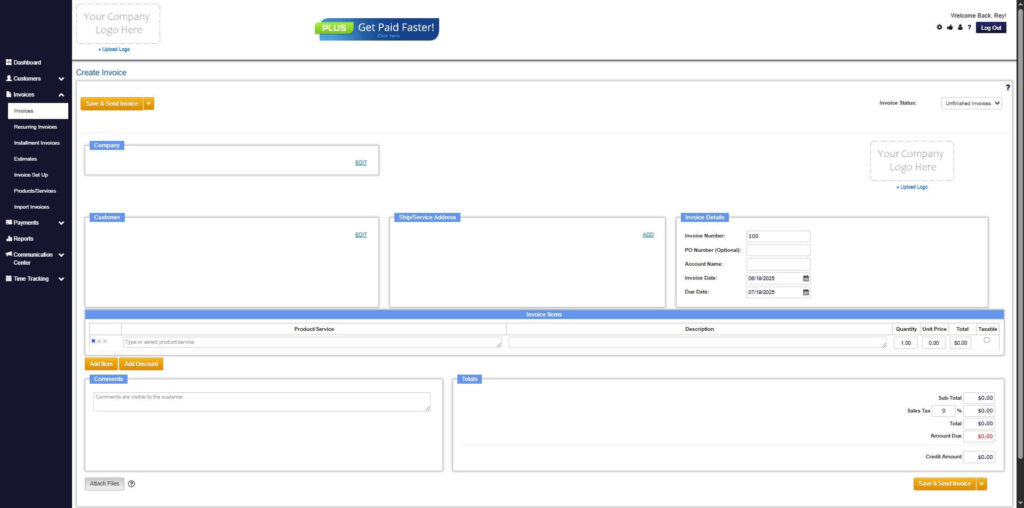

Step 6: Fill in the Create Invoice Form

- Fill in all the necessary fields.

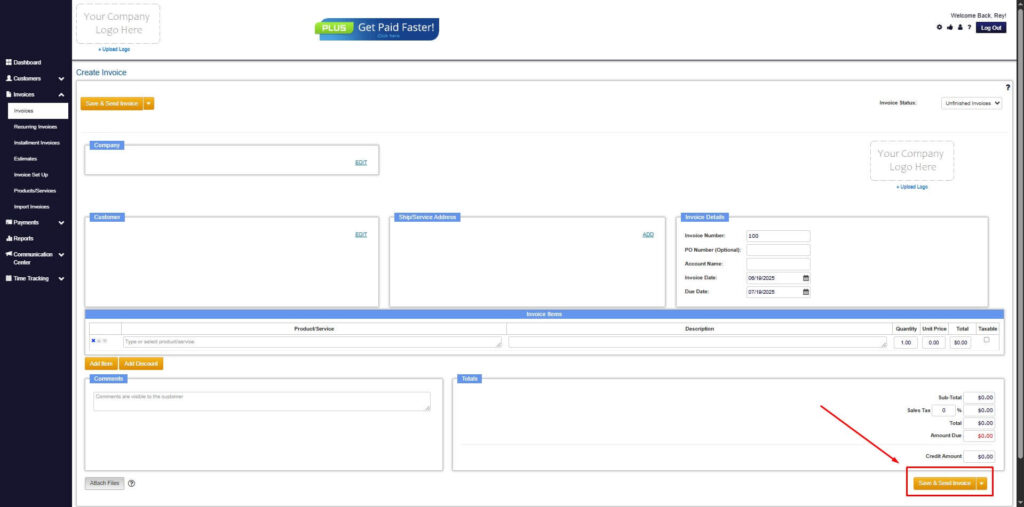

Step 7: Save Invoice

- After filling out the form, click “Save & Send Invoice” to continue.

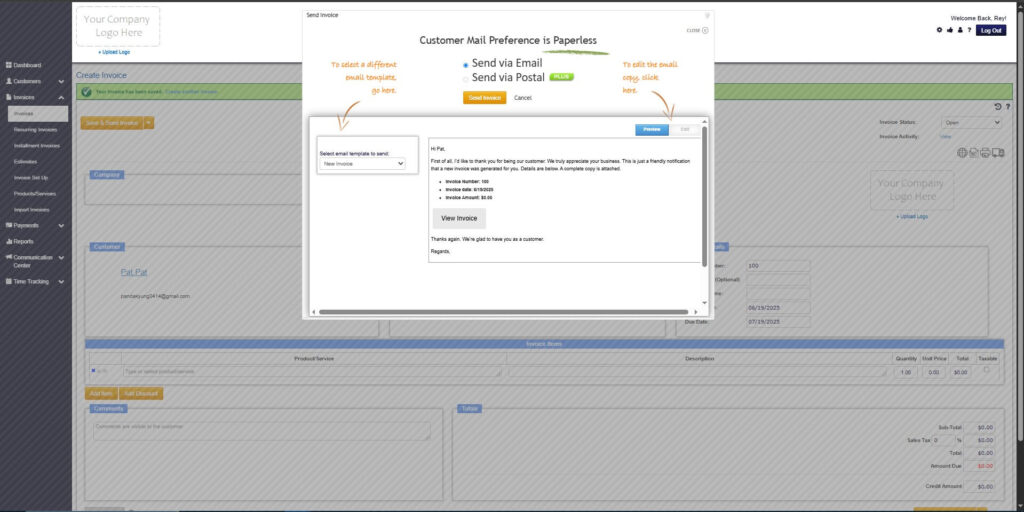

Step 8: Invoice Created

- Your Invoice has been created.

Wrapping Up

Having a direct deposit invoice is a great way to get paid. It’s faster than the traditional check and more convenient. So, if you’re planning to incorporate direct deposit into your payment methods, use this article as a reference. And if you want to automate your entire billing system, consider trying ReliaBills!