The business world involves a series of different terms and words that can be confusing to understand. Some can even be compared or be related to each other. Take the churn rate and retention rate, for example. Both of these terms are associated with each other; and while some may mistake one from the other, it’s essential to know that bot these terms are quite different. In fact, they are the two ends of the spectrum. To further understand the importance of knowing churn vs retention rate, this article will serve as a comparison guide that will differentiate one from the other.

Churn Rate and Retention Rate

While they may be related terms, both churn rate and retention rate are actually the exact opposites of each other. They both provide measured using different formulas and are also different in terms of purpose. To give you an idea of just how different they are, here are the definitions of these metrics.

What is Churn Rate?

In CRM (customer relationship management), churn rate is a term that refers to the percentage of customers or subscribers who cancel or didn’t renew their subscription during a given period. It’s is a critically important metric for any business or company that has its customer base paying on a recurring basis (e.g., subscription-based or SaaS companies). If your customer doesn’t remain lone enough for you to, at least, recoup your average CAC (customer acquisition cost), you’re going to have a hard time – regardless of your monthly revenue. That’s why it’s important to calculate churn to determine the area that you need to change to decrease that number and control the amount of churned customers. Your goal should always be to have a low percentage of churn as opposed to a high churn rate.

What is Retention Rate?

Retention rate, customer retention rate, or stability index, is the rate that indicates the number of customers you’ve managed to retain over a given period. A high percentage of retention means your marketing and customer care efforts are getting great results. A good retention number also means that you’re fortifying your business for the short and long term. Similar to churn, retention rates can fluctuate from period to period. However, consistent retention rates across a series of consecutive periods indicate growth and development for your business or company.

In other words, the rate of retention is the complete opposite of churn. Instead of calculating the customers who left, it focuses on the ones that remained. However, it isn’t just about determining how good of a job your marketing and sales teams are doing. At the same time, tracking this metric will let you know when you’ll need to make essential changes to make sure you reach your sales and growth objectives.

So as you can see, both churn and retention rates serve different purposes. One calculates the percentage of customers you’re lost on a given period while the other calculates the percentage of customers you managed to retain over a given period. So as you can, they are two ends of the spectrum. The definition of churn clearly states that it focuses on the number of customers that have unsubscribed to your services. On the other hand, rate retention refers to the amount of customers that you’ve managed to satisfy and has remained loyal to your company.

Both involve the existing customers that you have. However, they calculate for different purposes. But keep in mind that both of these metrics relate to each other very well and are important determining factors on how you should change or adjust your business moving forward. Now that we have that out of the way, it’s time to determine how to calculate churn and retention rates.

Calculating Churn Rate

There are four ways to calculate the rate of churn: Simple, Adjusted, Predictive, and the “Shopify” Method. We’ll go over each one of them to give you some insights into how you can calculate the amount of customers that churned over a given period of time. Keep in mind that these methods provide different results and are used depending on the situation.

Related Article: What is Churn Rate and How to Deal with It?

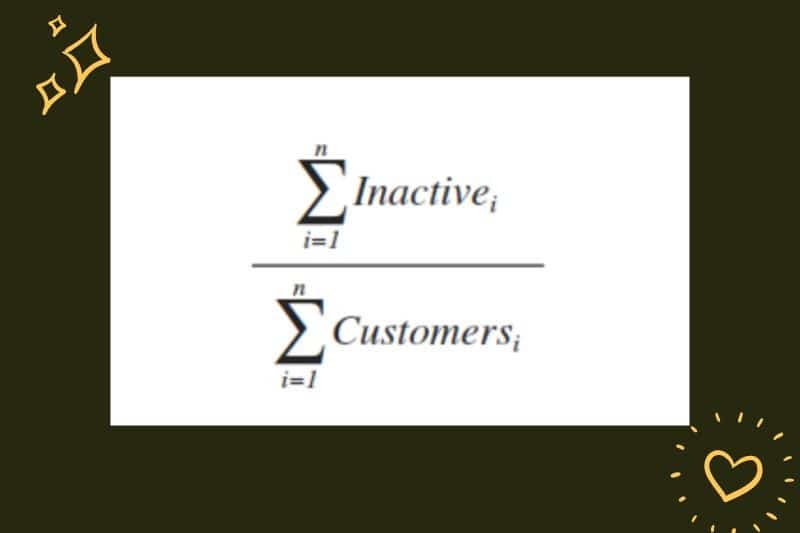

The Simple Method, as the name implies, is the most straightforward way of calculating churn. In this formula, you simply divide the total amount of churned customers over the period by the total number of existing customers that you had on the first day. The formula looks like this:

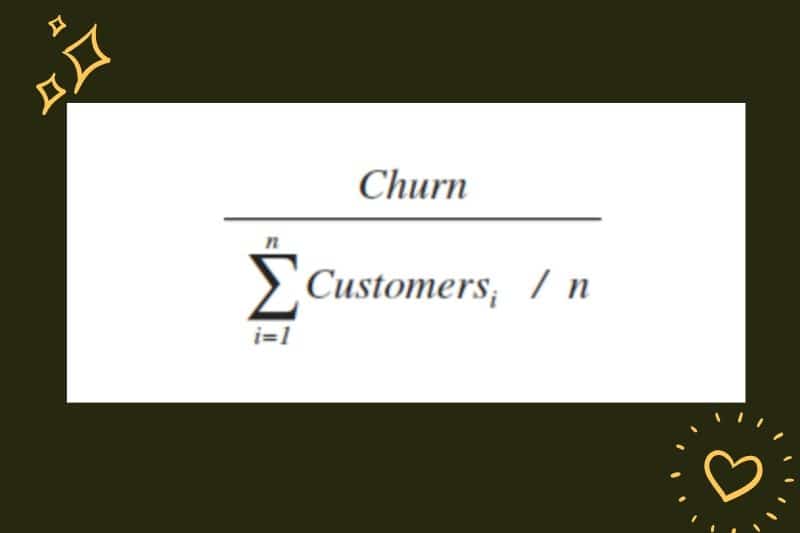

The Adjusted Method addresses monthly growth. That’s why in this method, the midpoint of the customer count for the month is taken instead of using the value on the 1st day of the month. That means you divide the number of churned customers by and adjusted average for the rate of customers throughout the period. The formula looks like this:

The Predictive Method incorporates a predictive element to determine a weighted average that will predict the likely churn value on any given time period. That means the number of existing customers that you have and the rate of the ones that churned can be predicted according to the trend that’s been going on in the past few months. The formula looks like this:

The “Shopify” Method is known as the one that produces the most reliable results. In this formula; instead of taking the average of the first and last days of the month, you take the average of every day within the month to get a more consistent and accurate calculation. The formula looks like this:

Keep in mind that the method you use for calculating your churn will determine the outcome and how you will adjust your business marketing strategy to lower the amount of customers that leave. Keep in mind that you’re trying to fortify your business or company for the short and long term. That means you need to keep your customers satisfied with your services. However, you won’t be able to know that if you don’t calculate churn. That’s why to ensure customer retention and growth, the issue of churn needs to be addressed first.

The churn definition clearly states that retention can only be attained once you’ve managed to determine the amount of churn and find a better strategy from there. Your business will benefit significantly once you’ve kept track of customer churn and found a way on how to deal with it. Customer retention will come naturally once you’ve managed to set up a new business marketing strategy. In addition, your company will also flourish, and the number of new customers that acquire your services will grow exponentially.

Calculating Customer Retention Rate

To recap, retention rate refers to the percentage of customers that you’ve managed to retain over a period of time. It implies that retention plays a vital role in determining the effectiveness of your marketing and customer retention efforts. Retention metrics also determine the rate of satisfaction coming from your customers. In other words, the higher your customer retention, the happier your customers are with your service. It also guarantees that the number of new customers that you acquire will consistently grow.

Calculating the percentage of customer retention isn’t as sophisticated as calculating for churn. By definition, churn involves a number of factors and situations that can alter the outcome completely; whereas, customer retention is a more straightforward approach. Customers that remained under your services for the first part of a given period is then compared to the amount of customers that you managed to retain after that period.

If a customer subscribed to your service in the middle of that period, that customer doesn’t count. It should only be the number of customers that you have at the start of that particular period. If you managed to have consistent retention metrics over a given period, it merely implies that your company is consistently satisfying your ever customer under your service.

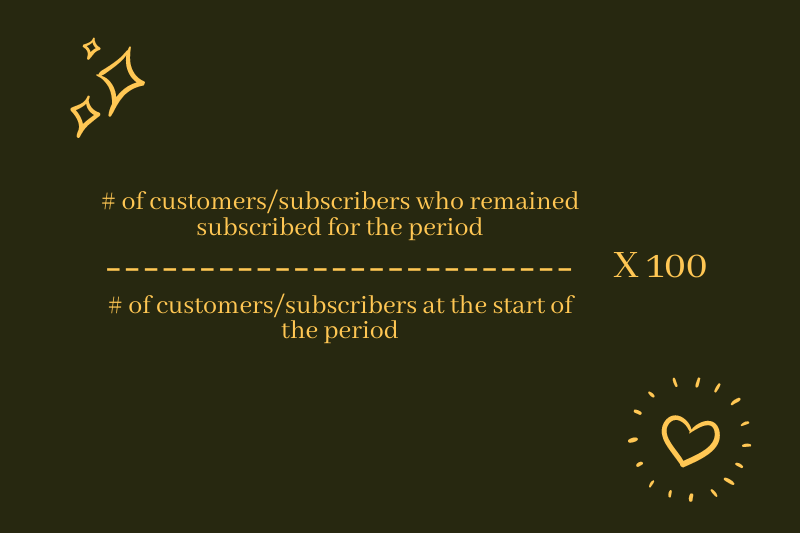

The formula for calculating retention is the amount of customers or subscribers who remained subscribed for an entire period divided by the customers at the start of the measurement period multiplied by 100. The formula looks like this:

When determining the number of customers who remained subscribed for the entire measurement period, be sure only to include those customers who were subscribed on both the first and last day of the period. Any new customers acquired within the measurement period are not counted, as the goal is only to track the retention of those who are subscribed from day 1 of the measurement period.

Retention is usually calculated on an annual basis, dividing the amount of customers with one year or more subscriptions by the number of customers a year ago. Smaller measurement periods can be used, as when tracking more immediate results of retention initiatives, or larger periods, as when calculating the retention of those customers who stayed after a reduction in customer numbers some years ago.

Why Both Relate to Each Other?

As mentioned earlier, customer retention is useful for showing the stability of your marketing and customer care efforts. However, the downside is that it doesn’t track the departures of customers who joined and subsequently left during the period being tracked. That’s why you should also calculate the churn rate to complement it with the retention rate. A churn shows the percentage of separations that happens in the same period.

The example below illustrates how retention and churn are not always the inverse of each other:

In a startup SaaS company comprising of eight customers, two left and were replaced during the measurement period.

- R (retention) = (6/8) x 100 = 75 percent

- C (churn) = (2/8) x 100 = 25 percent

However, what if during the measurement period, two slots became vacant, were filled, became vacant again and were filled again?

- R = (6/8) x 100 = 75 percent

- T = (4/8) x 100 = 50 percent

Tracking both metrics gives the employer a complete picture between retained and churned customers. That way, they can create better strategies on how to increase retaining customers and decrease the ones that unsubscribe.

How to Reduce Customer Churn Rate

The trick to retaining customers has a system that encourages them to feel satisfied and comfortable enough to keep acquiring your product or service. The first step is to build trust while encouraging recurring payments while avoiding your churn rate to increase.

The key to lower customer churn rates is establishing a recurring billing model that shows complete transparency and trust. You need to be clear with what subscription service or product you are offering. At the same time, you also need to know how customers expect their recurring payments to be made and how you can change the payment process whenever necessary.

The biggest challenge that your business will face is avoiding friction or misunderstanding with customers that can lead to unwanted payment churn. That’s why we listed a few strategies on how you can prevent these issues and overcome the challenges of reducing your churn rate as much as you can.

Complete Transparency

Ask any consumer, and everyone will tell you that they hate surprise charges on their accounts. Customers who don’t know how to expect a recurring bill are more than likely to dispute said charge or cancel or cancel their subscription altogether. That’s why it’s important to identify when they will expect a charge, what the charge will be, how often the charge will occur, and what the charge will show up as (for instance, a billing statement).

This approach is simple; you will need to be as honest and transparent to your customers as possible. Before you send them a recurring billing invoice, you will need to make sure they know it to ensure the most chances of getting paid.

Be Useful to Your Customers

By simply being available and useful to your customers, you give them the best reasons to comply with your recurring payment process. Present-day customers are savvier than ever, especially what products or services they are using. They can quickly change from your service to a potential competitor when the product or service you are offering no longer fits their needs.

That’s why your business needs to keep evolving and adapting to what your target audience is looking for. Keeping your customers happy and satisfied with your business is the key to successfully increasing their retention rate while reducing churn. Whether you’re offering promotions to attract and engage with customers with new options from your business or offering new features regularly, keeping your customers loyal and devoted to your business is crucial to decreasing the churn rate.

With recurring billing in place, you can do just that. The more convenient you are to your customers, the more they will see your business as valuable and relevant since you’re not getting in the way of living their lives. However, you’re still getting paid since you’re also billing them at the right date and time that they will be expecting your invoice.

Automate Your Billing Process

With ReliaBills and its recurring billing process, you can automate every aspect of your billing process. From creating professional-looking invoices to sending your invoices to your respective customers, recurring billing will do all of the hard work for you.

One major reason for payment churn is the ever-changing credit card details and credentials. Many customers frequently move without updating their billing address; cards tend to get issues with new details (numbers, CVVs, and expirations dates). All of these changes can potentially lead to customer churn once payments get rejected.

With recurring billing, you will be notified of everything that’s happening in your payment process. If the details on your customers’ payment information are inaccurate or outdated, the system will tell them to make the necessary changes to avoid payment failures. Once a failed payment does happen, your customer will be notified so that they can make the necessary changes to their payment details. Some software like ReliaBills even makes re-attempts to determine if the issue isn’t on the system itself.

Have the Right Processing Partner

Finally, make sure that you use the ideal payment processing partner to guarantee successful payment and lesser customer churn. Payment processing systems like ReliaBills offer the best recurring billing model since it features flexible payment method integration, easy sign-up, and payment terms, and a top-notch security system.

Wrapping Up

Both churn and retention rates serve different purposes when it comes to running a business. They provide different outcomes and have different methods to calculate. However, both of these metrics are related and serve great impacts on the overall growth and development of your business and marketing strategies. Check out the ReliaBills blog page now to learn other topics that might relate to your business or company.